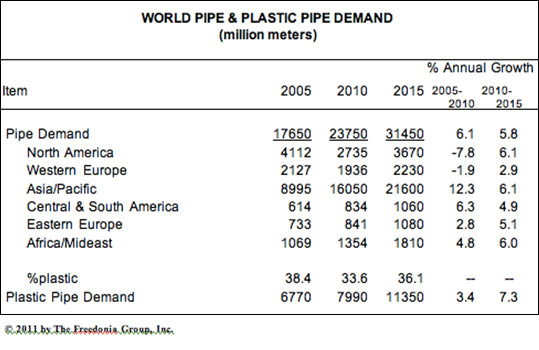

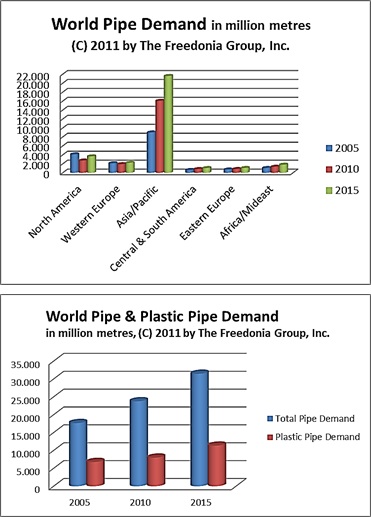

| World plastic pipes market is projected to reach 7.6 billion meters by 2017, as per Global Industry Analysts, Inc. Long term growth in the market clearly underlines a shift in balance towards the emerging markets, driven by heavy infrastructure investments and rise in construction activity. New product developments and application areas are expected to further facilitate market growth. World plastics pipe market is poised to register modest growth in the near term as the industry remains clouded by economic challenges. The market suffered a major setback during 2008 and 2009 after registering commendable performance in the past decade, especially during the period prior 2008, as the financial crisis swept away growth in most regions. Future growth in the plastic pipes market would be driven by huge infrastructure investments in developing countries led by the BRIC nations. This slowdown can be almost entirely attributed to China, the world�s largest consumer of pipe. After increasing rapidly from 2000 to 2010, Chinese pipe demand is expected to rise at about the average worldwide rate through 2015. Advances in North America, Eastern Europe and Western Europe are expected to accelerate through 2015, as these regions recover from the global financial crisis. The Africa/Mideast region and the rest of the Asia/Pacific region will also record faster growth, as local construction firms and industrial enterprises use pipe more intensely. The next few years are likely to witness the launch of new plastic products into the market. As plastics perform efficiently in utility water systems, cable protection, under-floor heating, and other similar applications, escalating opportunities in these areas are projected to bode well for plastic pipes in the future. Improvement in resin formulations that augment performance of pipes in challenging environments and improvements in processing methods would enable plastic pipe to be highly economical as compared to other competing materials. Segment-wise, Polyvinyl chloride (PVC) is expected to maintain its dominance in the plastic pipe market. Increasing use of PVC in small diameter applications such as agriculture-grade pipes, potable water distribution pipes and sanitary sewers is expected to further expand its share. High-density polyethylene (HDPE) pipe category demonstrates high growth prospects among leading plastic pipe resin categories. These pipes include less installation costs when compared to other varieties of plastic pipes and can also be modified according to application area. Europe and the US comprise the largest markets. Asia-Pacific, Middle East, Eastern Europe and Latin America are expected to display higher growth than the global average growth rate following increasing demand for plastic pipes in construction, telecommunications and natural gas distribution systems. Advancements in drinking water transfer systems, and sewage and drainage systems are also expected to drive the market for plastic pipes. Additionally, laying of natural gas distribution pipelines, which is currently underway or being planned in many countries is also likely to bolster the drive for plastic pipes. China represents the leading producer of plastic pipes worldwide with about 2,000 production lines. Majority of the new and expansion projects in the country are extensively making use of plastic pipes. The Middle East and African markets are also expected to witness rapid growth with increasing demand from local industrial enterprises and construction companies. The US is poised to witness continued prevalence of plastic pipes over conventional piping materials. A combination of factors including likely rise in state spending towards municipal and state infrastructure projects and a rebound in construction activity are expected to spur robust expansion of pipes market. In addition, pressing need to repair and replace the worn-out water pipe networks and increased oil and gas exploration as well as transmission related operations are poised to support pipes market expansion in the US. In Europe, the increasing thrust towards improving and expanding infrastructure networks across Eastern Europe is poised to expand the consumption of plastic pipes in the region. Major players in the marketplace include A.G. Petzetakis, Advanced Drainage Systems Inc., Amanco, C. I. Kasei Company, Chevron Phillips Chemical Company LLC, EgePlast A. S, Finolex Industries Ltd., Foshan Rifeng Enterprise Co., IPEX Inc., JM Eagle Company Inc., KWH Pipe Ltd., Mitsubishi Plastics Inc., National Pipe and Plastics Inc., North American Pipe Corporation, Pipelife International GmbH, Plastika AS, Polypipe Plc, Royal Pipe Systems, Sekisui Chemical Company Ltd., Shin-Etsu Polymer, Tessenderlo Group, Thai Pipe Industry Co., Ltd., Tigre SA Tubos e Conexoes, Uponor Corp., and Wavin N.V. The world pipe market is projected to expand 5.8% pa to 31.5 bln meters in 2015, a mild deceleration relative to the 2005-2010 period, according to a report by Freedonia. Freedonia says this slowdown can be almost entirely attributed to China, the world�s largest consumer of pipe. After increasing rapidly from 2000 to 2010, Chinese pipe demand is expected to rise at about the average worldwide rate through 2015. Advances in North America, Eastern Europe and Western Europe are expected to accelerate through 2015, as these regions recover from the global financial crisis. The Africa/Mideast region and the rest of the Asia/Pacific region will also record faster growth, as local construction firms and industrial enterprises use pipe more intensely.  Demand is forecast to increase 7.3% pa to 20.3 mln metric tons in 2015. Consumption of smaller-volume plastic pipe products such as ABS, GRP and PP pipe, will expand at an above-average pace, as end-users become more familiar with their technical characteristics and performance features. Increases in global construction activity and process manufacturing output will support growth. The North American plastic pipe market is forecast to grow more than 6% annually through 2015, as product sales in the United States recover rapidly. Plastic pipe consumption in the United States is expected to increase nearly 7% pa during this time, after it declined dramatically between 2007 and 2009 because of turmoil in the residential construction industry and the global financial crisis. More than two-thirds of all plastic pipe demand generated during the 2010-2015 period will be attributable to the Asia/Pacific region. Several major Asian countries are forecast to record rapid growth, including India, China and Indonesia. China alone will account for 40% of global plastic pipe demand generated between 2010 and 2015. Growth in the Africa/Mideast, East European, and West European plastic pipe markets will accelerate through 2015. In contrast, Freedonia predicts Central and South America will register slower growth than its industrializing counterparts as advances will be measured from a fairly high 2010 base  Advances in worldwide crude oil and natural gas production, and natural gas consumption are expected to stimulate demand for energy pipe. The agriculture and other segment will benefit from both manufacturing output gains and increases in the amount of land equipped for irrigation. Sales of pipe for construction applications are forecast to grow 5% pa during the 2010-2015 period, as global residential construction spending rebounds. Solid growth in nonresidential and nonbuilding construction activity will contribute to gains as well. As per CARE Research, with the growing consensus that the worst of the financial crisis behind us and demand for oil & gas products on an upward trend especially from the developing world, the need for new exploration and production (E&P) has reinvigorated. In addition, the recent political turmoil in the Middle East and North African (MENA) region has critically pushed the crude oil price above US$100/barrel benchmark leading to further interest in high cost offshore drilling activities which is back on full scale. In North America and other parts of the world including India, shale gas discoveries and extraction is creating a whole new market for pipes that needs to be connected with existing network. The replacement demand market for pipes from the matured markets has remained consistent throughout the volatile period on the back of higher infrastructure spending. In India, the government is focused on developing pipeline network by increasing the availability of city-based gas distribution (CGD) and is aiming to cover approximately 200 cities by 2015. Also, with the pipeline network of India for oil & gas transport being lower at 19,103 kms as on April 2010, (32% penetration level) it represents a huge scope for growth for the pipe industry. As most of the Indian pipe manufacturers are converters, the industry is highly Raw Material (RM) intensive with the RM cost accounting for more than 70-80% of the total cost for steel and PVC pipe companies. These companies rely heavily on imports and hence many steel pipe companies have backward integration facilities to reduce dependency on imports and price volatility. Freight cost is another key cost component due to higher imports and exports. Going forward, with the expected softness in international steel prices (due to correction in its raw material prices) and reasonably low level of Baltic Dry Index (a barometer for shipping freight rates), pipe companies will be benefited due to lower input costs. Indian companies produce a wide range of steel, cement and plastic pipes which are used in various critical and non-critical applications. CARE Research expects the positive trend in the Indian pipe industry to continue for the next 3-5 years on the back of higher E&P activities due to resurgence in crude oil price, increased efforts by the Government of India (GoI) on infrastructure development for laying pipelines for oil & natural gas transport (e.g. the National Gas Grid project), replacement demand from North America and European countries, water & sewage transport and irrigation facilities. The growth will mainly be driven by steel pipes especially SAW pipes. The order-book position (currently equivalent to total of FY-10 sales) of many steel pipe companies is sufficient for the next 6-12 months. |

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}