|

Shale gas developments in the USA will significantly impact growth in polyethylene (PE) film usage as well as global trade in finished film, according to AMI Consulting. This will lead to major reduction in the cost of PE resin in addition to reducing the energy cost of subsequent film production. It is highly probable that North America will have a polymer cost base on a par with that in the Middle East, leading to PE film exports from North America overtaking those of the Middle East. Looking beyond 2018, this projected cost advantage, when combined with the technological expertise of US polyethylene film producers, will ensure that they become truly global players. This represents a shake-up of the worldwide PE film market. Within the global marketplace, there will be real winners and losers.

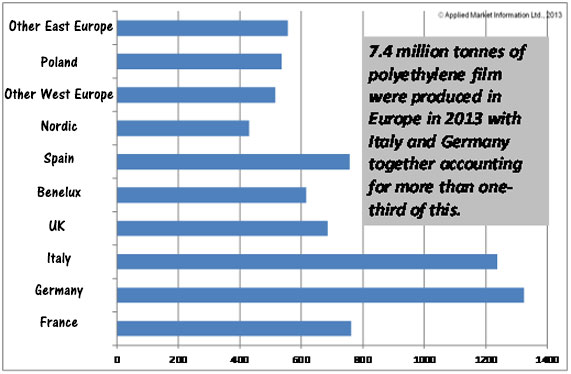

Other factors that will impact growth in PE film production include the continuing investment in export-oriented regions such as the Middle East and South East Asia, and growth of the middle classes in less developed regions. In 2013, North East Asia - including China - was the highest producer region with one-third of global production of PE film. Meanwhile, Western Europe accounted for 15% of global production and will continue to grow in terms of tonnage 'only because it remains one of the cradles of technical development of PE films'. In 2013, Northeast Asia (including China) was the highest producer region with one-third of global production of PE film, followed by NAFTA with a 17% share and Western Europe accounting for 15% of global production. By 2018, it is forecast that Northeast Asia will have increased market share of global production to over 35%, while NAFTA's share will remain unchanged and Western Europe's share will fall significantly, largely as a result of continuing economic difficulties in some of the member states combined with high costs of raw materials, energy, labour and freight.

Western Europe will continue to grow in terms of tonnage only because it remains one of the cradles of technical development of PE films (the other being NAFTA) and continued success will depend on a shift of business towards higher added value film products. Meanwhile the Middle East will increase its market share by growing production at over 10% pa, making it the fastest-growing global region in percentage terms. Inter-regional traded volume has grown significantly over the past few years to reach over 3 mln tpa, with Northeast Asia and Southeast Asia jointly accounting for over half this traded volume. An additional half million tpa is forecast to be traded by 2018, driven by increased volumes of film on the reel rather than bags and sacks, which will decline as a result of environmental initiatives in several global regions.

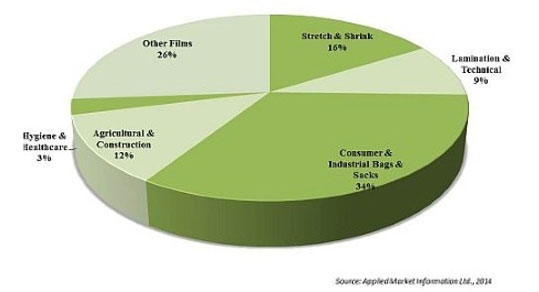

In terms of individual resin types, low-density polyethylene (LDPE) will continue to lose market share as processors adopt 'more sophisticated' linear resins in similarly complex formulations. Looking at market applications, the highest growth rate is forecast for stretch films on the back of increased usage is less well-developed countries as the proportion of sales through large retail outlets increases. Demand for bags and sacks is also forecast to grow appreciably, as is growth of technical films, agricultural films, heavy duty sacks and shrink films. In terms of individual resin types, LDPE will continue to decline in market share as processors adopt usage of more sophisticated linear resins in increasingly complex formulations, resulting in market growth of metallocene and higher alpha-olefin LLDPE grades.

The recession of 2008-2009 saw polyethylene (PE) film production drop by 10%. Although output is still approximately half a million tons below that achieved at the peak of the market in 2007, demand for film has continued to make a slow, steady recovery since then, as per leading plastics industry consultant, AMI.

To some extent it can be misleading to talk solely about tonnages because one of the success stories of the PE film industry has been its ability to down-gauge and reduce material weight through the use of innovative linear and metallocene grade material which allow extruders to create thinner, yet stronger films. In 2013, for the first time ever, the consumption of linear and metallocene grades by film extruders exceeded the usage of conventional LDPE grades. And this trend is here to stay, with AMI forecasting that the use of metallocenes materials in film extrusion will grow at a rate of 3 or 4 percentage points above that for the industry as a whole as more and more extruders develop products using them. Film extruders have been steadily increasing their use of linear and metallocene resins to adapt to consumer demands, which helps to explain the good growth rates in stretch and shrink film production. Shrink and stretch films, used to protect goods in transit, each accounted for 1 million tons of PE film production in 2013.

52% of plants are involved in the production of stretch film or shrink film for collation or pallet wrapping. This trend is reflected across Europe with Germany taking the lead, where 61% of film extrusion sites are producing shrink and stretch films. The leading producer of stretch film, the Italian group Manuli Stretch, operates one of the largest plants for stretch film in Europe in Schkopau, Germany. Despite the emergence of several new players, the PE film market remains highly competitive and while the number of sites may have grown, it is not necessarily reflected in the number of companies involved. Consolidation and restructuring continues to be a major feature of the film extrusion market. Creation of the Coveris Group, bringing together the PE film operations of Britton Group, Veriplast, Unterland and Kobusch; the acquisition of Nordenia by the Mondi Group; RKW's takeover of Hyplast, are all evidence of this.

|

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}