|

Global demand for polyethylene resins (HDPE, LLDPE, and LDPE) will rise 4% pa to 99.6 mln metric tons in 2018, valued at US$164 bln, as per a report by Freedonia. Gains will match overall world economic growth, fuelled by an acceleration in consumer spending and manufacturing activity. Polyethylene will continue to be the most widely used plastic resin in the world, benefiting from its versatility, easy processability, low cost, and recyclability. The development of ethylene feedstocks from new sources such as shale gas, coal, and biobased materials will also give polyethylene a price or sustainability advantage relative to other plastic resins. Moreover, continually improving polymerization catalyst technologies will enhance the performance, customization, and yield of polyethylene resins. HDPE is the most widely used of the three polyethylene resins, accounting for just under half of total demand in 2013. Analyst Kent Furst notes, however, that further increases in polyethylene demand will be limited by a number of factors: "Polyethylene is a highly commoditized and mature product, and large volume new applications are unlikely to emerge in the foreseeable future. Additionally, polyethylene (like all plastics) is perceived negatively by many environmentally-minded consumers, and major polyethylene applications such as plastic bags have increasingly become subject to regulations and bans."

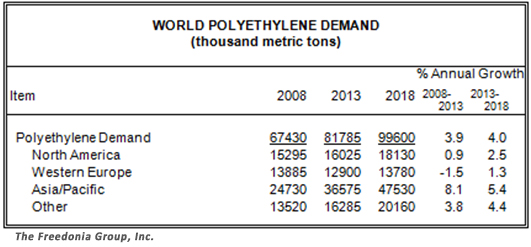

The Asia-Pacific region will continue to be the largest and fastest growing polyethylene market through 2018, fuelled by strong growth in China, which alone accounted for nearly one-quarter of global demand in 2013. India and Vietnam will also be among the world's most rapidly expanding markets. However, advances in most emerging Asian countries will rise at a slower pace than during the 2008-2013 period. On the other hand, North America will see a significant improvement in polyethylene demand, while the markets in Western Europe and Japan will rebound from recent declines.

Global polyethylene demand is forecast to rise by approximately 3.7% pa between 2013 and 2018, at a slightly higher level than its growth during the 2003 to 2013 period, says a report from GlobalData. This higher-than-historic increase will occur in the US and Europe, primarily in Russia. The US will witness a 2.4% growth rate pa during the forecast period, in comparison to its 0.7% levels from 2003 to 2013. Meanwhile, demand in Europe, including Russia, will climb at 2.8% pa from 2013 to 2018, almost three times the level witnessed during the last decade. These demand rises in the US and Russia will be somewhat offset by a lower increase of 4.8% in Asia, compared to its 6% rate during 2003 and 2013. This will be due primarily to the region's slower economic growth.

Carmine Rositano, GlobalData's Managing Analyst covering Downstream Oil & Gas, says, "Lower feedstock costs from US shale gas production are providing the country with a competitive advantage, with increasing investments in its petrochemical plants driving polyethylene demand growth in both domestic and international markets. Although below recent historical levels, demand in Asia remains fairly robust and will continue to boost expansion in the global polyethylene market. As a result, polyethylene capacity is now expected to increase at about 5.3% per year between 2013 and 2018, which is higher than the 3.6% experienced over the last decade. Capacity additions will be most prevalent in the US, given its advantaged cost competitive position, and also Russia, which is augmenting its petrochemical industry to reduce its reliance on imports. New capacity will also continue to come online in Asia, but at a slower-than-historic rate."

GlobalData states that despite the lower estimated cost of crude oil in the forward price curve to 2018, prices for polyethylene will increase at around 1.3% per year up to the end of the forecast period. This is attributable to petrochemical demand increasing at approximately three times the rate of that for oil. The key trend emerging in the polyethylene market will be the ongoing surplus position in the US, where excess production will be directed to expanding markets in South America and Asia. Additionally, the lower feedstock and fuel costs for US plants, compared with those in Europe, will likely result in future European plant closures and further adjust global polyethylene trade flows.”

Global polyethylene demand growth is expected to ramp up fairly soon, averaging almost 5% pa between 2012 and 2017, as per Nick Vafiadis, Sr director of global polyolefins and plastics for IHS Chemical, as reported by PlasticsNews. Annual growth of 4.6% in that five-year span will have global demand sitting at just over 216 bln lbs by 2017. "That growth exceeds the current level of North American demand," Vafiadis said. "That's like growing another North America in the next five years. The market has mass and momentum." In North America, that momentum is coming from newfound supplies of natural gas, mainly from shale rock formations. These new supplies can be used to make ethane and then ethylene feedstock. The discoveries have led to a wave of expansion announcements, including around 11 bln lbs of new PE capacity that's set to hit North America toward the end of that five-year forecast period. These projections don't even include new capacity from Ineos Group and Dow Chemical Co. that just were announced in late March. "Strong margins are leading to capacity increases," he said. Much of the new North American PE capacity will be targeted at export markets, which are expected to grow by 5% over the forecast period. Domestic demand also is expected to improve toward the end of that period. One positive impact of the new North American PE capacity should be a resurgence for the region's PE processors, especially makers of film and bags. As North America gets new production capacity, there will be an increase in processor capacity in the U.S. The domestic market will become more competitive. Some big U.S. processors will expand to take advantage of the new [PE] capacity in North America. leading to increased exports of [PE] finished goods.

Globally, PE capacity additions in that span are expected to exceed 57 bln lbs. But some regions will benefit more than others. Growth in the Middle East will continue to move forward as countries there invest in infrastructure and a growing population drives consumer markets. Europe's PE market, however, is expected to struggle, with demand down and imports on the rise. More than 2 bln lbs — about 7.5% of Europe's PE capacity — is expected to be shut down by 2017. In China, PE capacity and demand are headed up, but operating rates are expected to remain low. The challenge for that country's PE market, Vafiadis said, is to rationalize higher-cost plants and to move away from commodity products. No new PE capacity is slated for Latin America through 2017, which will improve that region's operating rates. Globally, new PE capacity should lower global operating rates almost 1%, from 84.2% in 2007-12 to 83.4 percent in 2012-17. North America's PE operating rates will be the highest in the world in that 2012-17 period, ranging from 85-90%. "U.S. producers [from 2012-17] will have the luxury of being able to export and get healthy returns to every region in world. That will keep operating rates high. Post-2015, U.S. producers will have to rely on export sales outside of South America. China's influence will leverage down export prices and the domestic price as we move to global price parity. When the new PE capacity arrives in North America, some producers "will put an emphasis on domestic supply," Vafiadis added. "So we could see North American prices drop lower for a short period until global operating rates improve." |

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}