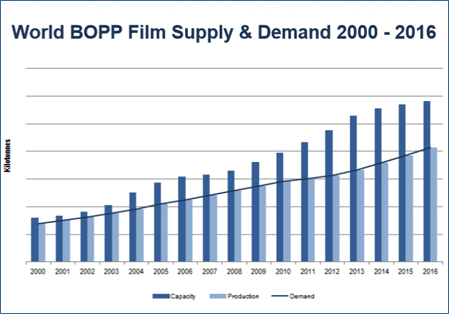

BOPP film has been one of the global success stories in flexible plastics packaging. This is now an industry which produces over 7 mln tpa of substrates, worth more than US$18 bln, according to a new report on the Global BOPP film market from AMI Consulting. However, it is increasingly an industry that is driven by markets and areas of the world that historically have been considered "developing nations". This is not just a function of market volumes and growth rates, but also market leadership as the major players in the BOPP market today are now head quartered in what AMI is calling the CHIME nations - China, India and the Middle East. Over the past three years the BOPP film industry has been through a period of major structural change with the emergence of two major power houses with sales in excess of US$ 1 bln: Jindal Poly Films based in India and Tahgleef Industries headquartered in Dubai. Jindal Poly Films takeover of ExxonMobil Chemical Films, completed in 2013, creates a group with the largest nameplate capacity for BOPP at over 400,000 tons with assets based in Europe, the USA as well as being the largest producer in India. Taghleef which AMI estimates to be just behind Jindal in capacity terms, has similarly built a global position through the acquisition of various heritage businesses in Europe and North America. In 2012 it completed the takeover of AET Films in the USA and only recently has announced another acquisition in Europe with the takeover of Derprosa in Spain. Despite these impressive moves, these two businesses still account for less than 10% of global production and are likely to be overtaken - on a volume basis at least - by Chinese producers over the next few years. The investment in capacity and growth in demand for BOPP films in China has been well documented but the leading producers there are now looking to move to whole different level. From the original business model of setting up a large plant with 3 or 4 big lines, the leading players are now looking to build a network of plants within China with state of the art 8.7 metre and 10.4 metre high speed (525 mts/minute and more) lines and to vertically integrate into polypropylene resin production. The rapid growth of businesses such as the Gettel Group and China Soft Packaging - backed by cash rich real estate businesses - is leading the Chinese industry to have its own structural shakeout. Many of the early movers there have sold off assets, moved out of the sector or are looking to develop more speciality, niche products unable to compete in the commodity packaging sector. Demand for packaged foods, and the subsequent need for BOPP film packaging, has weathered the recession relatively well, facilitating world BOPP film demand growth of an average 6.1% pa over the last five years, to reach over 6 3 mln tons in 2011. PCI’s ‘conservative’ forecasts show world demand for BOPP films will continue to grow by an average of 6.6% per annum to reach 8.3 3 mln tons by 2016. Growth in Asian demand is expected to account for a vast majority of the predicted world growth over the next five years.

Report highlights include: |

|

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}