|

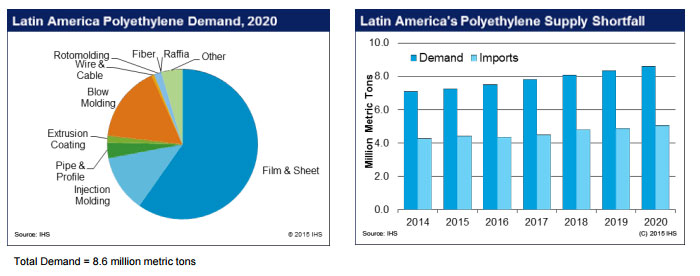

Demand for polyethylene (PE) is growing in Latin America thanks to an expanding middle class, with demand for PE (in all forms) currently exceeding 7 mln metric tons (MMT), as per IHS Chemical. However, the region’s current and planned PE capacity will continue to fall short of demand, driving the region to import approximately 50% of its PE needs by 2025, The region's current net deficit is at over 3 MMT of polyethylene, and will approach 5 MMT by 2025, according to a IHS Chemical Special Report.

“Today, as a region, Latin America does not currently produce enough polyethylene to meet its needs, and is facing a supply deficit that is only going to increase during the next decade,” said Raul Arias Alvarez, senior director of consulting at IHS Chemical and lead author of the special report. “This lack of future PE capacity expansion in Latin America has been caused by the lack of competitiveness of regional feedstock resources compared to U.S. shale-based production, combined with the region’s reduced access to financing, which in turn, resulted from the global economic crisis” As a result, the PE imbalance will be sustained and will increase as the economy starts to improve, further driving plastics demand in the region, Arias Alvarez said. Inevitably, he said, PE imports will have to increase to meet demand. Home to approximately 634 mln people, including a large, youthful population, “Latin America is expected to see its GDP decline 0.7% in 2016, but should recover thereafter, driving greater consumer demand for a host of durable goods that are made from plastics,” said Rafael Amiel, director of economics for IHS Global Insight, and a contributing author for the IHS Chemical PE special report. In 2017, the region will benefit from a less pronounced recession in Brazil as policy makers and politicians there partially agree on measures needed to fix the economy, Amiel said. “Commodity prices and external demand will no longer be a drag on growth for most economies in the region, so we at IHS expect a soft recovery will take place, driven by domestic consumption and investment. This growth in consumption demand will directly impact demand for plastics made from PE.”

To meet its growing needs for chemicals and plastics, the region will not have to look far, since its U.S. neighbor will be adding more than 100 MMT of new petrochemical capacity by 2025, including approximately 8 MMT of PE capacity during the next five years. Globally, PE expansions will reach nearly 24 MMT during the 2015 to 2020 timeframe.

Brazil is the biggest market for PE in the region, representing 36% of demand, followed by Mexico at 26%. Argentina follows with 10% of regional plastics demand, then Colombia and Chile both at 5%, IHS said. High-density polyethylene (HDPE) is the most-consumed polyethylene type in the region, representing 43% of total PE demand. Known for its strength and durability, HDPE is used in numerous, diverse, applications including plastic bags and bottles (milk, laundry detergent), piping and construction materials, as well vehicle gas tanks. LLDPE is known for its flexibility and stretchiness, which makes it ideal for use in plastic wrap and stretch wrap, as well as toys and other applications, and is currently driving 31% of the PE market demand in Latin America. Low-density polyethylene (LDPE) represents the smallest segment at 26% of PE consumed, and is used primarily for plastic bags, packaging and other applications. Film and sheet applications, which is key to the packaging sector, is the most important plastics use segment in the region, representing more than 60% of plastics demand.“Even though film and sheet growth has been relatively modest, its magnitude has been a key factor in generating PE growth in the region, in part because it is essential to the region’s agricultural and livestock production and exports,” said Arias Alvarez. “As our report partner, MaxiQuim, has verified, in Brazil, in particular, this agricultural sector has played a significant part in the nation’s GDP in recent years and was among the highest performing industries in Brazil in 2015.”

Blow molding segment represents 16% of PE demand in Latin America, while injection molding accounts for 11% of PE demand in the region. In terms of capacity, PE production exists in only 5 countries in the region: Argentina, Brazil, Colombia, Mexico and Venezuela. In April 2016, Braskem/IDESA initiated production of ethylene and PE at their Ethylene XXI project in Mexico, however, IHS does not anticipate other large grassroots projects for ethylene or PE to start in the region through 2020. “Down the road,” Arias Alvarez said, “there is opportunity for the region to invest in domestic PE production, particularly in countries like Argentina, which has a good industrial base, and the luxury of shale resources that may bring new light to its energy future, revitalizing its petrochemical industry.”

A surge in new capacity coming from low-cost producers in North America, the Middle East and China is driving the global market for polyethylene (PE) and polypropylene (PP) to oversupply, which will pressure margins for producers and change the global competitive landscape, according to another analysis from IHS Chemicals. Of the over 24 MMT of new PE capacity that will be added globally during to 2020, approximately 8 MMTwill come from the U.S. This will significantly increase the U.S. net-export position for PE and PP and other chemicals, rebalancing the global chemical trade flows that have favored the Middle East for decades. Beyond North America, China is also growing its influence as a key, low-cost provider of PE, thanks to its production additions from coal-to-olefins technology, Nick Vafiadis, global business director of polyolefins and plastics said. China is expected to add approximately 17 MMT of new PE/PP capacity during the next five years, which will drive further market volatility.

In Europe, imports of PE into Europe from the Middle East in 2016 have surpassed 2015 numbers as the region continued to see strong demand and offered attractive net-backs for Middle East producers, IHS said. HDPE import figures for January and February 2016 overall, were the highest of the last eight years at 148,000 MT, and exports were lowest for the same period at only 42,000 MT. IHS said a similar, but less pronounced, trend is occurring for other PE grades as well. “According to our IHS Chemical forecasts, we expect Asian pricing for PE to remain depressed for the remainder of 2016, and with European producers giving little margin away, this will mean netbacks from the Middle East to Europe will remain attractive in the coming months,” Vafiadis said. “The net result will mean PE imports will continue to arrive in Europe at relatively high levels from the Middle East.”

|

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}