|

|

|

|

Rigid film business in Europe is restructuring to achieve better profitability |

|

|

| |

Rigid film business in Europe is being restructured with increasing participation of private equity players, says new research from Applied Market Information, Ltd. AMI estimates that the 50 largest rigid film and sheet producers profiled in its report were responsible for 2.6 mln metric tons of polymer consumption last year, equivalent to 60% of the total European market.

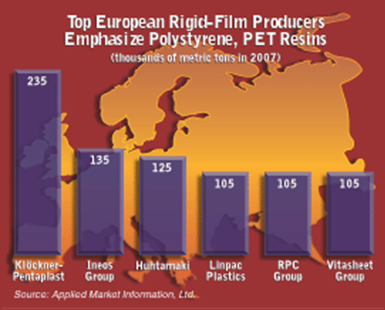

The largest rigid film and sheet producer in Europe is Klöckner Pentaplast, a supplier of rigid PVC film and sheet. The group has expanded significantly in recent years with several key acquisitions, not only expanding its core business but also moving it into complementary markets such as PET. There has also been some restructuring and consolidation of its units with the closure of plants in Norway, The Netherlands and Spain, and the sale of its flexible-packaging business; simultaneously, it has also built new facilities in Portugal and Russia . This has enabled Klöckner Pentaplast to consolidate its position as Europe's leading player with production in Europe last year estimated to have reached nearly a quarter of a mln metric tons of product and 500,000 tons worldwide. The group has been under private-equity ownership since 2001 when it was acquired by Cinven. In May 2007, it changed ownership with Cinven selling it to the Blackstone Group.

Ineos Group, the second-largest producer in Europe, is also a major rigid PVC film and sheet provider. However, with 2007 production projected at 135,000 metric tons, it is some 100,000 tons smaller than Klöckner. Known as the former EVC Films business, Ineos has attempted to improve returns through fixed cost-reduction programs, and reorganizing and simplifying business structure. It moved to consolidate its position in the rigid-films arena through the 2005 acquisition of Solvay's rigid-films business.

The Finnish group Huhtamaki is Europe's leading manufacturer of thermoformed-polystyrene packaging with production, of just over 120,000 metric tons for 2007. It too has been restructuring its sheet business to improve sales competitiveness. Expanded PS packaging units in France and Portugal were sold in June 2006, while two sheet and thermoforming plants were closed in the UK during 2005. Production was also transferred from Göttingen , Germany , mainly to Poland and Spain during 2006, and the site closed. Its plant at Portadown , UK , was sold to an unnamed buyer in January.

Three other groups produce more than 100,000 metric tpa in Europe : RPC, Linpac and Vitasheet. The latter two are both owned by private-equity groups, and recent announcements from RPC that it is looking at its strategic options has led to speculation it may soon join them.

EUROPE 'S 10 leading film and sheet manufacturers are:

|

|

| 1 |

Klöckner Pentaplast |

Germany |

PVC, APET |

| 2 |

Ineos Group |

UK |

PVC, PET |

| 3 |

Huhtamäki |

Finland |

PS, PP, PET |

| 4 |

Linpac Plastics |

UK |

PS, PP, APET |

| 5 |

RPC Group |

UK |

PP, PS, PET |

| 6 |

Vitasheet Group |

UK |

ABS, PP, PE, PS |

| 7 |

Coexpan |

Spain |

PS, PET, PP |

| 8 |

Groupe Guillin |

France |

PS, PP, PET |

| 9 |

Quinn Group |

UK |

PMMA, PETG, PS, PC, SAN |

| 10 |

Veriplast Solutions |

France |

PS, PET, PP |

|

|

|

|

| | | | | | |

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}