|

|

|

|

|

Will challenges in petrochemicals sector in Q3-09 be followed by a trough in 2010? |

|

|

| |

Profitability of the petrochemical industry strengthened in Q3-09. However, high feedstock costs have pushed many European and Asian producers towards the uncompetitive end of the global cost curve as per ChemSystems.

The economic performance of the petrochemical industry improved in the third quarter, after H1-09 had been one of the hardest periods since the early 1990�s. Consumption of petrochemicals continued to recover steadily as economies improved, particularly in Asia. Meanwhile rising feedstock costs of most naphtha based petrochemical producers considerably reduced competitiveness for established players in export markets. The weakening dollar and the renewed cost advantage of ethane based production in the United States combined with high domestic feedstock costs to push European and Asian producers towards the uncompetitive end of the global cost curve. The cost advantage of Middle Eastern producers with access to low cost feedstock costs widened as crude oil prices strengthened further. Margins meanwhile were ultimately supported by a very tight supply side, as extensive cracker outages restricted supplies of olefin feedstocks required for production of derivatives.

The relative strength of Asian demand for petrochemicals has provided a solid foundation for the recovery of the global petrochemical industry from the sharp downturn experienced in H2-08. However Asian petrochemical markets showed some signs of weakening in the third quarter. A long awaited recovery in Japan, which emerged from recession in Q2-09, after five consecutive quarters of contraction, was more than offset by a slowdown in the Chinese manufacturing sector. Exports of finished goods from China have been very subdued, in what should have been the busiest period of the year, as retailers in Western economies drastically reduced orders for the end of year festive period, anticipating restricted consumer spending. Meanwhile an extensive set of clean air mandates, imposed by the Chinese government ahead of an extended national holiday at the start of October, reportedly caused further shutdowns in the manufacturing sector. Domestic consumption of petrochemicals in Western Europe increased in Q3-09, as the regional economy continued its steady improvement. The German economy lead the way, growing by 0.3% in H2-09, and other countries are expected to emerge from recession in the second half of the year. However, overall volumes continued to be well down on peak volumes seen in H1-08, and imports made their presence felt, both from the Middle East and from a newly competitive United States. The United States saw demand improve from the weak opening quarter of 2009, but remain very fragile, with volumes lagging far below the highs seen in H1-08. Consumption of ethylene derivatives improved modestly as the United States economy stabilized, with GDP contracting by just 1% in Q2-09, and many economists expecting a recovery from recession in the second half of the year. Production rates in the automotive sector, a key consumer of petrochemicals, increased considerably in the third quarter, as sales grew strongly in response to a government incentive scheme to replace less efficient vehicles.

The renewed strength of crude oil prices in a demand constrained environment has made feedstock selection a vital source of competitiveness in the third quarter. Average Brent crude oil prices through July and August gained 17% over the second quarter to settle at almost US$70/barrel, the highest for a year. Meanwhile, the spread in the price of alternative petrochemical feedstock costs has widened considerably. Naphtha supplies from refineries have shortened, with weak gasoline demand and pressure on margins. Tight naphtha markets lifted European naphtha prices a further 5% relative to crude oil. Propane continued to trade at a steady discount to naphtha, on slow seasonal demand in heating applications. Producers in the United States however were largely insulated from the recent rally in crude oil prices as ethane prices rolled over from the second quarter, with very long gas markets softening the link with crude oil values in the short term. Inventories in North East Asia climbed considerably in Q3-09, with storage constraints often restricting further increases. The supply side continued to lengthen as new cracker and derivative capacity came on stream. Shanghai Secco restarted production at China�s largest cracker after completing an expansion and Fujian Refining and Petrochemical started production at their new cracker. These two projects alone accounted for an increase of 2 million tons in Chinese ethylene supplies vs the second quarter. A rally in Asian prices in the second quarter had attracted large volumes of imports into the region, which arrived just as demand was beginning to stall. Growing inventories rapidly depressed Asian prices through the third quarter, closing many export opportunities for Western producers. Ongoing curtailment of Iranian ethylene supplies into South East Asia, maintained tighter markets in South East Asia. However increased supplies of derivatives were seen arriving from the Middle East as earlier production issues were resolved and material from newly commissioned plants began to slowly work its way into the market. Inventories in Europe and North America meanwhile remained heavily depleted, with consumers reluctant to rebuild stocks, fearing a repeat of last years collapse in prices in the second half of the year. Despite the fragile demand side, petrochemical markets were largely kept tight through the third quarter, with a shortage of olefins severely constraining production of derivatives. Almost a quarter of European cracker capacity hit production issues during September, keeping average industry operating rates below eighty percent for the fourth quarter in succession.

Middle Eastern producers have meanwhile built on their advantage at the top end of the global cost curve, as feedstock prices maintained a strong regional advantage and netback prices for petrochemical sold into Asia and Europe increased. Ethane based producers in the United States were also able to sell ethylene and derivatives into Western Europe at a considerably lower cost than domestic production at naphtha complexes in the third quarter. Steady strengthening in the Euro against the dollar further aggravated the cost position of European producers, relegating them down the global cost curve. European producers were displaced from many export markets in the third quarter and exposed to larger volumes of imports

The outlook for the petrochemical industry depends upon many factors beyond producer�s control: What is the outlook for crude oil price? How will the global economy develop? How will the strength of the dollar impact regional competitiveness? As per Nexant�s latest petrochemical profitability forecasts, the price of crude oil and the growth rate of the global economy potentially have the greatest influence on the future performance of the petrochemical industry, yet they are amongst the hardest measures to predict. The price of crude oil is of critical importance to petrochemical producers, as the prices of the majority of petrochemical feedstocks directly track crude oil. The price of crude oil thus heavily influences the raw material costs of production of petrochemicals. Meanwhile, the strength of the global economy is a fundamental driver of demand for petrochemicals, with strong economic growth yielding robust consumption of petrochemicals. Strengthening demand generally allows producers to raise prices to support higher margins. Given the extreme volatility and hence uncertainty in crude oil prices, Nexant has continued to model a wide range of crude oil scenarios to allow clients to understand the impact this key feedstock has on petrochemical prices. The medium oil scenario which assumes that crude oil prices will remain around US$75/barrel, while a high case sees oil maintained above US$100/barrel through supply restrictions. A low case at around US$30/barrel is also defined to bracket the likely trajectory of crude oil prices in the coming years. The revised growth outlook sees major markets contracting in 2009, with key regions only achieving flat growth in 2010. GDP is then expected to grow rapidly again, as industries rebuild inventories and confidence returns.

2008 saw a dramatic reduction in global olefins demand, with full year consumption estimated to be 10 mln tons down on that seen in 2007. The considerable investments in supply occurring in Asia and the Middle East meanwhile raise concerns for a considerable downturn for petrochemical producers. The abrupt slowdown and contraction of the global economy has fundamentally reduced the consumption of olefins, and even with renewed GDP growth, will take a number of years to recover lost demand.

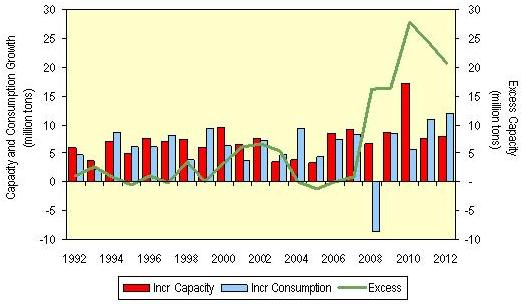

Global Ethylene and Propylene Balance

Whilst consumption growth is much beyond the control of the industry itself, the supply side, over which it has direct influence, presents an alarming divergence. Commissioning of new capacity, will deliver unprecedented growth in olefin supply, at a time when existing units have already been mothballed due to weak demand. The profitability of petrochemical production has historically been heavily influenced by the amount of excess production capacity, typically measured by the industry average operating rate. Higher operating rates have generally supported stronger production margins. The start up of major new capacity built at low feedstock cost locations in the Middle East, and major consumption centres in Asia, will depress global operating rates to the end of the decade. Producers in Western Europe and the United States will come under considerable pressure, and uncompetitive units may be forced to close. The excess supply will have a marked impact on profitability in all markets, exacerbated by the abrupt downturn seen in the last quarter of 2008.

Petrochemical prices are determined by adding the production costs of typical producers to the margin sustained by the market. Production costs are heavily influenced by the raw material costs which themselves tend to track crude oil markets. The magnitude of the margin is strongly influenced by the regional market balance, with tight markets supporting higher margins.

The petrochemical industry did a very reasonable job as it negotiated the rapid surge in crude oil prices experienced over the last five years right up until the middle of 2008. The high prices however did finally cause demand to fall, which was then exacerbated by widespread fear of holding inventory in a falling market. This inventory affect has impacted throughout the manufacturing sector and has been further impacted by credit constraints on consumer expenditure. The outlook to the end of the decade is one of many threats which are expected to result in a very weak industry outlook.

|

|

| | | | | | |

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}