| During the past few years, the global PVC market had been growing around 4% pa. Growth rates in the developed world had been slipping as these markets matured while stronger demand growth has been seen in Central and Eastern Europe as well as Asia, in particular China and India, as per ICIS. However, in 2008, global demand plummeted by 8% compared to 2007 with total consumption falling to 33 mln tons, according to US-based consultants CMAI. Deteriorating economic conditions with its impact on the construction sector combined with destocking along the chain were the main reasons.

PVC demand in Asia had grown at close to 8% pa from 2003-2007 but in 2008 it shrank by 6% with most of it occurring in the last four months of the year. Over-stocking was initially blamed, but in reality it was just the beginning of a global recession. In China, PVC demand contracted by nearly 1 mln tons in 2008, with most of the demand destruction in the last quarter, after the Beijing Olympic Games. Much slower growth is expected in Asia over the next five years and it is likely that the demand levels seen in 2007 will not be reached until 2011. Demand growth rates could reach 7% pa by 2012-2013. Demand growth in China is expected to recover to GDP growth levels by 2010 and a full recovery by 2011. CMAI forecasts that PVC demand in China will reach 12 mln tons by 2013, about 2.9 mln tons higher than 2008.

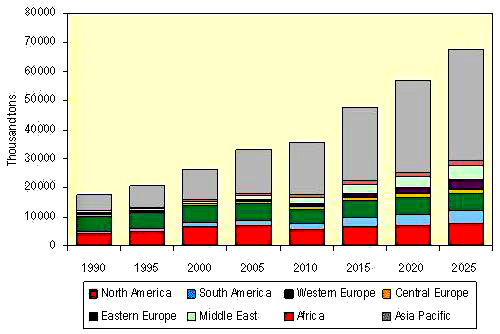

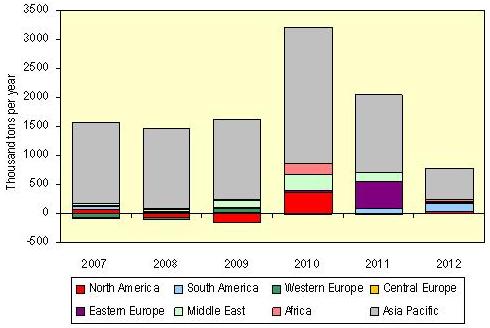

Demand in the Indian Subcontinent is expected to be resilient. While demand growth will slow in 2009, growth is expected to accelerate above 10% pa from 2010 to 2013. The Chinese government is currently undertaking a US$600 bln investment program to develop infrastructure in interior China, which will be the main driver of PVC demand in the future, as per globalmarketsdirect.com. China has the world�s largest PVC capacity using acetylene feedstock and most of the future capacity additions will also be based on acetylene feedstock. Even with these large capacity additions coming up in the country, China will emerge as the largest importer of PVC in the world. The Chinese PVC demand will grow by 15% annually and account for 44% of the global PVC demand in 2020. In Europe, PVC has been one of the slowest growing commodity polymers with usage becoming more and more concentrated in certain segments such as window profiles and pipes and fittings. In other areas such as packaging and bottles and short-lived consumer groups, PVC�s share has been shrinking with its replacement by polyethylene terephthalate (PET) and polyolefins. The year 2009 saw the worst growth in construction business in Europe. After over 13 years of uninterrupted growth, the sector is estimated to have shrunk by 8.4% at the worst prediction, as per ICIS. 2010 is not likely to fare any better. The construction business is expected to decline by 1% in 2010 before growing 1.5% in 2011. The average revenue of European construction companies is forecast to fall by 5-10% by the end of 2011 due to weaker economic conditions and difficult credit. This does not foretell a good year for PVC since over 75% of PVC finds application in the construction business. Volatile price of PVC in 2009 due to excessive supply against weaker demand created another problem for the weak construction business. Most of the PVC converters feel that PVC may show a modest growth of 2-4% in 2010. However the processors fear that margins will be very thin. The window market in Germany is expected to recover better due to the Government�s plan to spend �2 bln for rebuilding of public buildings and housing along with some financial stimulus to the construction industry. Central and Eastern Europe are expected to recover better in 2010. A look at the difference in per capita consumption between West, Central and East Europe shows enormous potential for PVC growth in Central Europe and the Commonwealth of Independent States (CIS) countries such as Russia, Ukraine and Kazakhstan. To reach the same level of consumption in West Europe, CMAI estimates it would require roughly 6 mln tons of additional PVC demand. West Europe dominates the region with 6.8 mln tpa PVC capacity in 2008. In the 2009-2013 period, around 730,000 tpa of new capacity will be added, primarily in Russia and the Ukraine. However, delays to the start-up of some of the larger Russian projects are likely due to a shortage of ethylene and the economic downturn. The PVC industry in the US faces an uncertain and potentially grim future in 2009. Demand for PVC construction materials is in a big slump and the global economic downturn has offered few signs that the situation will improve within a year. After the US mortgage meltdown brought a sharp downturn in new home construction in 2007, the PVC industry had hoped the housing market would recover in 2009 but has seen its hopes grow dimmer as the US economy slides deeper into recession. US PVC exports in Q1-2009 has shot up by 36% from Q1-2008. The weak US dollar and growing demand overseas has encouraged US PVC exports with Egypt, China and India being the top three destinations. The Middle East has been a bullish market for PVC. Demand is estimated to have grown by 12-13% in 2007 and 9-10% in 2008. However, growth is expected to decline once construction projects are completed and new infrastructure projects are delayed due to liquidity constraints and the economic slowdown. PVC demand growth during the last decade in the Middle East region was second to only the Asia Pacific region. The demand was driven by large scale construction projects in Iran, Saudi Arabia and UAE, which are some of the largest exporting countries of crude oil and natural gas in the world, and the high oil prices of the past few years have immensely benefited their economies. The construction sector is the principal driver of PVC demand, globally. Low per capita consumption of PVC and greater economic development in the fast growing developing countries of China, India and Brazil are driving the global demand for PVC in construction applications as per Global Markets Direct. Pipes & tubes and profiles account for the bulk of the PVC demand from this sector, with pipes & tubes accounting for nearly half the demand for PVC from construction applications. A significant number of the population in these developing countries lack basic infrastructure including housing, potable water and sanitation facilities and the work undertaken by these countries to address this situation will drive the demand for PVC from construction applications. Hence, demand for PVC in construction applications from the developing countries will compensate for the slowdown in traditionally large markets of North America and Europe, and account for 61% of the global PVC demand in 2020. As per ChemSystems, high consumption growth in populous nations such as China and India will make Asia the major driver of global PVC consumption growth. While consumption in the United States has been declining since 2004, growth in Mexico and a recovery in the United States demand will support future growth rates in North America. Western Europe will show the lowest growth, due to the already high per-capita consumption, and low GDP growth outlook. Growth in Eastern Europe and the Middle East is running at very high rates due to oil wealth, while demand in South America will benefit from high GDP growth and infrastructure development. Regional PVC Consumption  Regional capacity development shows considerable variation due to the sharply differing consumption outlook and production costs. Low growth and high energy prices make investment in North America and Western Europe unattractive. Some major capacity developments, mostly for exports, are already underway in North America, which have proceeded despite the ongoing contraction in domestic demand. Capacity development in China is proceeding rapidly due to the massive demand growth and the relative attractiveness of coal based production. Other parts of Asia show minimal development due to the lack of competitively priced feedstock and abundance of capacity already installed. Despite legitimate environmental concerns, the development of acetylene based capacity in China shows no sign of slowing because of local feedstock availability. The government�s effort to restrict the construction and expansion of less efficient, environmentally hazardous plants has had little impact on the overall pace of development, the only impact being prevention of progress of some sub-scale projects. Regional PVC Capacity Additions  |

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}