Packaging is the largest market for plastics- accounting for nearly half of all polymers processed in Europe. In 2007, this amounted to 18.2 mln tons of material in a business worth an estimated EUR 54 bln. In volume terms plastics is estimated to account for 21% of all packaging materials, while in value terms it holds a higher share of the market at over 30%.

According to AMI the market for packaging plastics has reached a state of maturity in Western Europe, with regional growth slowing to a level roughly in line with GDP. In contrast, many Eastern European markets are experiencing dynamic growth driven by lower labour costs, rising consumer spending and recent accession to the EU. Even so, the markets of Western Europe still accounted for 89% of polymer demand for use in packaging in 2007. The largest market is in Germany , but Italy and Benelux have larger per capita demand for polymer in packaging. This reflects the presence of major export oriented processors in these countries, particularly for film and PET preforms. Within Western Europe, the UK has one of the lowest per capita consumptions as a result of declining demand for polymer because of plant rationalizations and increased imports of packaging.

The market within the Central European countries of Poland, Hungary, Czech and Slovak Republics, Baltic States, Slovenia, Bulgaria and Romania has only really been able to achieve significant growth since the early 1990s following the collapse of the former Communist regimes, driven by investments from the leading global food and consumer product manufacturers such as Unilever, Danone, Procter & Gamble and many others. The recent growth of Western owned supermarket and hypermarket chains such as Tesco and Carrefour in Central Europe have also influenced consumer choices and expectations. Strongest growth has occurred in the use of PET for bottles and in PE stretch films and packaging films.

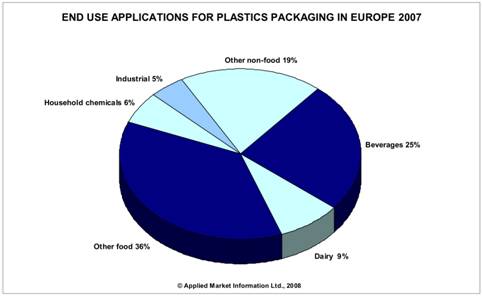

The main market served by plastics packaging is the food and drink industry. Nearly all types of plastics materials find some application in this sector, which is estimated to account for 70% of all polymers used in packaging. The major non-food packaging markets where plastics are used are industrial products, household chemicals, cosmetics/toiletries and medical/pharmaceutical.

Another report by AMI studies the trends for European market for plastics closures. The report asserts that the European plastic closures market in 2007 was estimated at €.5 bln. One-piece plastics closures are slated to grow at 4% annually, owing to the developments in sports drinks and juice-based drinks. Further, the mounting market penetration of lightweight polyethylene terephthalate (PET) will accelerate the growth of one-piece closures. Responding to the heightening demands from customers to lessen raw material cost, beverage makers in Europe are increasingly using light weight closures. The HDPE one piece closures comprise 64% of all the standard beverage closures, a staggering 9% rise relative to 2004 figures. However, custom closures like pouch spouts and non-standard diameter flat caps, can offer additional value to manufacturers. As a result, this custom closures segment is predicted to grow because of a strong demand for sports closures. The market for plastic beer closures is expected to grow following the use of plastic cork for glass bottles. Plastic beer closures' demand will mainly root from Eastern Europe. As per the non-drink application for plastic closures is concerned, liquid food segment shows a strong growth potential in Europe owing to the advancements in heat stable PET, clarified PP and multilayer containers . The replacement of glass containers by plastics in table top sauces, baby food, cooking sauces, dehydrated and snack products will also fuel demand for non-drink applications of plastics closures. Adding, sustainable packaging and innovations will be the core of plastic closure production over forthcoming years with increasing emphasis on ease of use, handiness and modernity. Also, reduction in weight of closures will play an integral role for increasing customer demand. By this practice, producers can reduce their equipment's impact on the environment and get a quick ROI simultaneously. Furthermore, rising costs, competitive pressures and presence of private equity groups in Europe are leading to restructuring and reorganization within the European rigid film and sheet manufacturers. Klöckner Pentaplast, the Europe 's biggest supplier of rigid PVC film and sheet has not only undertaken key acquisitions but also diversified into PET sheet manufacturing. Last year, the firm's European production amounted to nearly 250,000 tons. Since 2001, the firm was under an equity ownership which was then purchased by Cinven, which in turn, sold it to Blackstone Group around mid-2007. The firm had shut down its plants in Norway , Netherlands and Spain including the sell out of its flexible packaging business. However, it started new facilities in Portugal and Russia . Ineos, Europe 's no.2 PVC film and sheet maker was formerly EVC Films business which was bought by the Ineos Group in 2001 and delisted in 2005. Since then the group has been attempting to improve returns through fixed cost reduction programs, restructuring and reorganization of business. In 2005, it bought out Solvay's rigid films business, based on two other Italian companies, the former Caleppiovinil and Adriaplast. Adriplast facility was closed down in 2007 in order to improve operational efficiency across the firm's sites in Italy .

Coming to North America, plastics has become the largest used material in the US with other materials including glass, paper, board and metal have seen their proportions dropping in the recent years and are further expected to see a downfall. One research conducted in the US showed that rigid plastics amounted to 23% and flexible plastics captured 15% of all the packaging materials by the end of 2006. Another study conducted by Freedonia has analyzed that plastic film demand will rise by 2.6% annually through 2012. By then, the combined markets for resins, additives, processing and other costs will stand at US$32 bln. Out of this, the US market for resins alone will be worth US$13.4 bln with the demand touching nearly 16 bln lbs. Interestingly, the study says that yet-to-be released bioplastics will see the demand surge by 15% annually though will still have a minimal share in the total plastic film usage. Importance given to sustainability by a number of companies will result in curtailment in the demand for polyvinyl chloride (PVC). Also, this resin is expected to be under the scanner by the environmental organizations in the region. The dropping use of magnetic tapes and films in the US may result in slowing demand for PET; however, other applications for the resin are expected to expand. Lastly, low density polyethylene (LDPE) and polypropylene (PP) films will rule the roost as far the resin consumption in the US is concerned. The markets including food-produce, snack packs, stretch & shrink wrap, and trash bags will result in increased consumption of LDPE films. Otherwise, milk-produce, dairy and other food applications will create a surge in demand for PP films.

|

|

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}