| What is Volume Cost? The Volume Cost of a raw material input is the purchase cost of a unit volume of the material. It is extremely important to understand the Volume Cost of Polymers and its additives as this plays a key role in their selection for a particular application. Volume cost (Rs./Litre) = Purchase Cost (Rs./Kg.) x Density (Kg./Litre or gm/cc) Let us examine the Volume costs of the major commodity Polymer families. One of the first characteristic of a polymer that a designer looks at before specifying it as the material of construction is its price. These vary from time to time, sometimes wildly, but tend to maintain their proportion vis a vis other polymers. Here are the recent prices of the Commodity thermoplastics (Ball park figures)

While it would look that UPVC is by far the cheapest Polymer, the natural question is that why does it have such limited applications in, say moulded products? Assuming that UPVC was as easy to mould as the other Commodity Thermoplastics, why is it not used in such widespread applications like buckets? At this point we have to look at one of the very important properties of Polymers, which many a time is overlooked. Fortunately this is not a property which changes with time.

The Density of a polymer is measured from a fully gelled and fused sample and should not be confused with Bulk Density, which is the apparent density of the granules or powder that the Polymer is sold as and is measured prior to processing. Bulk density has more relevance to rate of flow through hopper throat of the processing machine, tendency to bridge/stick and other handling and storage considerations. Bulk density can change depending on particle size/shape, but Density of a Polymer is constant. When the volume cost is plotted, a completely different picture appears. Polypropylene now becomes the cheapest  As we have taken the example of the household bucket, it is interesting to note that they were first moulded in LDPE in the early 60s. As HDPE became available in the late 60s, its lower volume cost was one of the reasons why there was a whole scale shift by bucket manufacturers to HDPE. Of course the better stiffness and warm water resistance of HDPE were major factors for the shift, but the lower Volume Cost helped. In the 90s, Polypropylene has also made inroads into the Bucket market, aided no doubt by its lower Volume cost, though its superior clarity, stiffness and temperature resistance were also factors. It is smart marketing which has positioned the clearer and stiffer PP Bucket as a premium product sold at higher prices than its HDPE cousin. As they say, �Pricing depends on marketing policy while Costing depends on facts�, and the fact is that the volume cost of the higher priced PP Bucket is lower than the HDPE one. That is to say that if PP and HDPE are injected into the same bucket mould volume, lesser amount of PP in Kgs would be required. It is a separate matter that the PP bucket mould would be different with perhaps a thinner wall to cash in on PP�s higher rigidity, but the reality of better volume cost remains. PVC was never in the picture because of its higher Volume cost. If its volume cost had been lower than the Polyolefins, ways and means would have been devised to mould it into buckets! Perhaps this example is too simplified as there are many factors which have to be considered to select the correct plastic for a specific application, but the point I am getting at is that Volume cost is a less understood but extremely important factor. Importance of Volume Cost to the Plastics formulator The consideration of volume cost is even more important when Polymers are compounded with additives. The density of the final product can change considerably especially when mineral fillers are added primarily to reduce costs. Volume cost and its implications are not properly understood by many entrepreneurs, formulators and persons undertaking cost reduction/value engineering. It is vital to understand its implications before embarking on cost reduction exercises. They are priced either per piece (Mouldings) or per unit length (Pipes, Cables, Tape). Thus the costing and pricing are for fixed Volumes. As the Plastic Raw materials are always purchased per unit weight, the tendency is to do cost calculations on a Per Kilo basis, and the finished product is priced accordingly to the weight per piece. However, in the marketplace, competitive pressures often force the entrepreneur to offer discounts to protect market share. The discount is normally a percentage of the existing selling price, which, in the majority of cases is the realization on volume basis. If cost calculations are done on Per Kilo basis, many times the reduction in cost by adding fillers/extenders is calculated as a percentage of original formulation cost. The savings may be translated into a price reduction based on this percentage. After some time the entrepreneur realizes that he is sustaining losses as the reduction in Volume cost was nowhere near the Per kg. cost reduction on which the discounts were based, especially when mineral fillers are the main cost reducing input. All Mineral fillers have a higher density than most plastics. Rigid PVC Pipes is a prime example. The ease with which Calcium Carbonate can be loaded and processed by modern twin screw extruders has led to mindless loading of fillers in a desperate bid to reduce costs. The pitfalls are many as is illustrated:

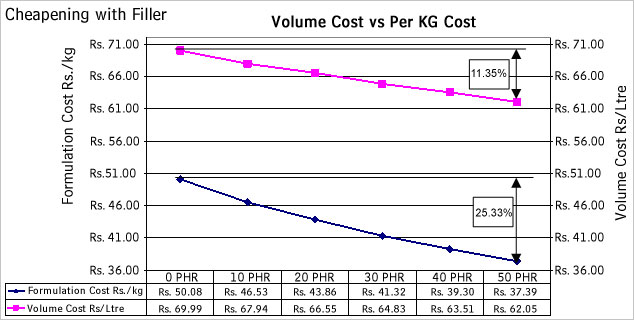

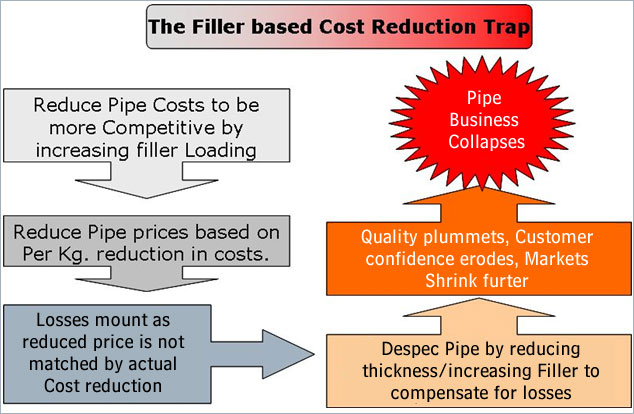

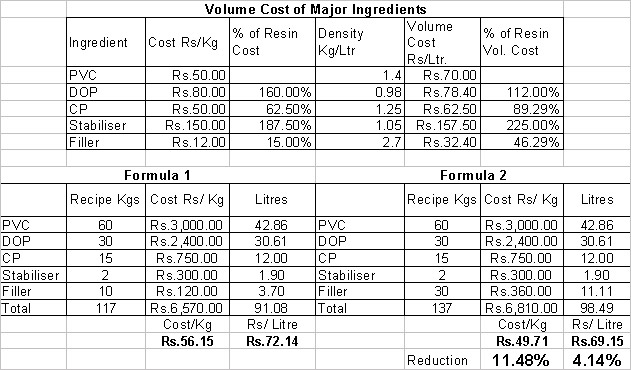

It is interesting to note that even though these are theoretical calculations, the predicted density is quite near the actually measured density, with the difference being a few points in the third decimal place. Rarely do we find errors in the second decimal place. Assuming that the pipe is gelled fully and has no voids, the density figures predicted are quite close to actual. There is some volatile loss, but in a Pipe formulation this is a low percentage. The graphical representation shows the big difference in the reduction in cost when measured per kg and the volume cost  By adding 50 PHR Calcium Carbonate (not unusual in commercial grade PVC Water supply Pipe and in the non pressure applications like SWR) the expected cost reduction appears to be a healthy 25%. However, in actuality, the Volume cost has reduced only 11%. Such a high loading of filler not only ruins Pipe impact strength and pressure resistance, the wear and tear on costly twin screw equipment is severe. Thus it is not worth sacrificing so much of quality deterioration and machine life reduction for a mere 11% reduction in cost. This should be understood by all PVC pipe manufacturers and other sectors which rely on dense mineral fillers primarily for cost reduction. Of course nobody makes pipes with 0PHR filler, around 8-10 PHR filler is the optimum level for good quality pipe conforming to BIS 4985, and also acceptable Screw Barrel life, and it is heartening to note that most of the quality conscious PVC Pipe manufacturers have persisted with such formulations and have been successful in the long run. It is when higher loadings are resorted to for cost reduction that a vicious cycle starts. Let us say a manufacturer increases his Filler loading from 10 PHR to 40 PHR. Relying on formulation costing he expects a reduction of 15.5%. He reduces the prices of his pipes by 15% from his BIS 4985 price. However his cost per length of pipe has gone down only by only 6.5% (the Volume Cost reduction). Soon he finds out that he is losing money, so what is the next step? More filler loading coupled with decreasing the wall thickness of the pipe, deteriorating quality even further. And the downward spiral in quality and shrinking returns continues.  This is a most dangerous trend. Many Polymer applications in India have faced declining demand due to loss in confidence of the consumers because of repeated failures of poor quality cheap products. Examples are too numerous, and is most saddening to persons and companies who have worked so hard in establishing such applications. In the Pipe field itself, one can recall the hammering HDPE pipes took in the early eighties due to large scale failure of pipes made from scrap HDPE and sold to prestigious Government projects as prime grade pipes. While HDPE pipe market languished because of the bad name, PVC Pipes surged ahead. It has taken two decades for HDPE pipes to claw back to good volumes, which involved consistent quality and development of new application areas like Drip and Sprinkler Irrigation, Gas piping, Large diameter sewerage pipes etc. as well as consolidation in the core water supply sector with good quality pipe with second generation HDPE grades. A dangerous fallout of mindless filler loadings is when markets change from pricing per piece or in the case of pipes, per unit length of specified thickness to pricing on a per kilo basis. Such a change encourages higher filler loadings and should be resisted by all discerning manufacturers. In plastics, heavier does not mean more �Mazboot� (strong). Physical properties are seriously compromised in PVC products made heavy by excessive filler additions. With Polyolefins, the situation is different. Here fillers like Talc and Calcium carbonate are added to improve stiffness to PP, or desired properties like antifibrilation in HDPE or PP Rafia Tape. Incorporation of Fillers in Polyolefins is an expensive process, requiring costly co-rotating Twin screw extruders. Compounding costs for filling Polyolefins can be as high as Rs. 10-15/kg., while in PVC the increase in dryblending cost is negligible. Filled Polyolefins (10-40%) are costlier than the base polymer because compounding costs outweigh the lower filler cost. The volume costs go up sharply, but requirements of better stiffness in Auto Components, Moulded Furniture and other technical parts is the driving force for filler addition. It is only at filler levels of over 50%, as in filler masterbatches, that the cost per kilo dips below Polymer cost levels, but the volume cost will be adverse. Thus normally filler addition does not automatically lead to cost savings with Polyolefins as it does with PVC. This is why Polyolefin Pipes cannot be cheapened by adding filler, like in PVC, and it is volume cost considerations which determine this. Volume cost implications with Filled Polyolefins will be examined in a subsequent paper. Glass Filled Polymers is a special case with the fillers price sometimes exceeding the Polymer prices. It should be obvious that Glass filling is done purely to improve mechanicals. In Flexible PVC, considerations of Volume costs come into play. Large amounts of Plasticisers and extenders (Secondary Plasticisers) are used. The volume cost calculations are similar, though the contraction in volume in Flexible PVC compounds is a bit more because of volatile constituents in the liquid added. Here is a simple example of a soft PVC compound stabilised with a mixed metal Stabiliser/ESO mix. It is interesting to note how the relative costs of the other ingredients change in relation to PVC Resin when viewed from the Volume cost angle. Plasticisers like DOP which per kilo is much more expensive than resin has always been thought to be the reason why Plasticised PVC is costlier than RPVC. But DOP, for example, is not that costly from the Volume cost viewpoint. In fact when PVC prices had flared up, DOP was actually cheaper than Resin on a per liter basis.  Here again, an expected cost reduction by tripling the filler loading is considerably eroded on a Volume cost basis. Secondary Plasticisers like the popular Chlorinated Paraffin family have a higher density than the primary plasticiser. Higher the chlorination, higher the density and lesser the cheapening effect. Apart from Filler, CP is the favoured cost reduction tool. It takes considerable skill to balance the compatibility with the chlorination level of the CP selected with the addition PHR to achieve an effective cost reduction without compromising quality. Those PVC processors tempted to take the high filler route should pause and rethink their strategy. One of the reasons that so many PVC Pipe and profile extrusion firms have collapsed and closed shop is that they got caught in this vicious cycle higher filler loading- decreased wall thickness � product failures � compensation claims and were trapped with heavy losses. There are other ways of reducing costs which do not impact quality and offer value for money. PVC processors should explore and exhaust all these other routes before going up on filler levels. (Source Courtsey: Siddhartha Roy, Consultant, RoyPlasTech) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}