|

|

|

|

|

Significant upturns for thermoplastics in Europe, if economic growth sets off in 2010 |

|

|

| |

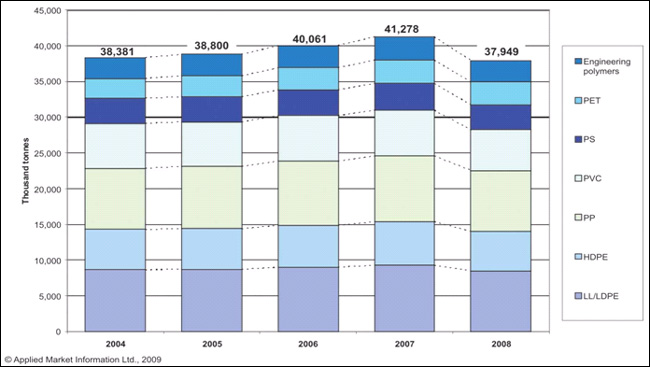

The plastics industry in Europe has not experienced such difficult market conditions as seen in 2008 since early 1980s. Demand for thermoplastics slumped in 2008 by 8% compared with 2007, according to AMI. Two years of better-than-average growth was seen in Europe, wherein demand reached a peak of just over 41 mln tons in 2007. The growth of 2007 masked underlying structural weaknesses of over-capacity, under-investment and poor competitive positioning of many plastics processors. This was followed by the great economic downturn that affected not only Europe, but the entire world. AMI expects the recession to drive significant restructuring within plastics processing markets with growing investment from outside Europe and a continuing drift of manufacturing to East Europe. Market demand began to slow during H1-08 as concerns began to surface about the liquidity of the banks. Record high oil prices also put the squeeze on polymer converters. Even so few were prepared for the precipitous slide that occurred from August 2008 as the uncertainty created by the global economic environment translated into a rapid decline in consumer confidence and had the effect of wiping out five years of growth for polymer in just four months. In the last quarter demand declined on average by 20-25% for most resins.

AMI points to massive converter destocking during the final quarter of the year as the main culprit. As oil prices plummeted and with it polymer prices, there was a reluctance to buy stocks in a falling market and tie up capital given the financial crisis and the lack of liquidity. Buyer sentiment among polymer converters during the final quarter of the year was very weak. Rapidly weakening consumer demand through the second half of the year also impacted heavily on converter operations resulting in cutbacks and short time working throughout the continent. The crash in demand affected all polymers, applications and markets to a greater or lesser extent. Some packaging, medical and hygiene markets held up better than others, but anything feeding into building, automotive or discretionary consumer products saw unprecedented drops in demand. PET saw one of the smallest percentage declines, primarily because most of its use is found in packaging. Even so the 3% decline recorded for 2008 is unprecedented for a material more use to growing at 6% pa. In addition to weak economic fundamentals PET markets were affected by the cool summer and weakening consumer demand for bottled water in Western Europe.

Demand for thermoplastics in Europe 2004-2008

Polyolefin (polyethylene and polypropylene) demand was down between 8-10% for 2008. Construction markets were especially weak in the face of the collapse in housing markets impacting on demand for pipe and cable products. Food packaging markets saw some contraction as converters destocked but industrial packaging markets were more severely affected by cutbacks in chemical production and general manufacturing. Volume demand was also impacted by trends in down gauging and re-engineering to strip out costs. Automotive and domestic appliance markets were very weak as consumer spending on large ticket items dried up.

The grimmest performance was in PVC were the market contracted by more than 11%. This followed two years of relatively strong growth for this material with the market reaching a new peak of 6.4 mln tons in 2007. 2008 though set the market back by more than 10 years as the downturn impacted heavily on production of pipe, cable, window profile, automotive and flooring products. PVC has relatively low exposure to the packaging sector as well, so it felt the downturn even more keenly.

The market for GP-HI polystyrene was also down sharply by 9% following a better than expected performance for 2007 when it displayed some rare growth. Underlying fundamentals for this resin though have been weak for some time thanks to a combination of a loss of manufacturing capacity for electrical goods and consumer products in Western Europe, together with volatile pricing in relation to competing materials such as PP.

Engineering resins, which in general had been enjoying growth rates at twice the rate of commodity polymers in the 5 year period to 2007, saw a 7% drop in demand for 2008 and these markets are expected to remain weak through 2009 because of their greater dependence on manufacturing trends in automotive production and electrical goods. With the outlook for car manufacturing expected to remain weak through the remainder of 2009, recovery in these markets is not expected to emerge until 2010 or later. The decline in demand was most marked in Western Europe, particularly in the UK and Spain which both saw double-digit percentage drops in polymer demand caused by the collapse of property markets and subsequent consumer demand weakness. German demand was least affected by the downturn sustained in part by continuing demand from the east and lower levels of consumer debt. The slowdown in Central and Eastern Europe did not really hit converter buying until much later in the year, but demand has been very weak in these countries during Q1-09.

With GDP forecast to contract by 4% for the EU27 in 2009, AMI sees no quick return to growth for polymer demand. Certainly polymer production and demand have been weak through H1-2009 with little evidence of re-stocking through the supply chain. Demand has remained weak with processors buying strictly to order. Although there have been some inklings of recovery in markets mid-year, primarily driven by the packaging sector, the overall outcome is expected to be a further 3-4% drop in volumes of polymer processed in Europe for 2009.

The growing maturity of plastics processing markets in Europe mean that increasingly its fortunes are linked to the underlying economy. However, given a return to economic growth from 2010 onwards there is expected to be some significant up turns for thermoplastics in the period 2010-2013. Packaging markets will be relatively strong, particularly in Central and Eastern Europe, although these trends may be offset by downgauging trends. Hygiene and medical markets will remain strong and automotive applications should recover once car production picks up again but this is likely to be of more benefit for plants to the East with further rationalisation of capacity expected to be seen in Western Europe. Building markets will pick up driven by government-backed stimulus programs and ongoing demands for improved energy efficiency. However, the process of adapting to the new economic environment will lead to winners and losers amongst processors. Companies will need to be innovative, technically proficient, and lean; cost conscious and not burdened with excessive debt in order to survive.

|

|

| | | | | | |

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}