|

The BRIC (Brazil, Russia, India, China) composites market is expected to witness good growth over the next five years. China has been the leader among the BRIC countries in terms of total composite consumption, whereas India depicted the highest growth rate due to rapidly increasing demand from the end user industries. The BRIC composites industry growth rate differed across various market segments depending on price-versus-performance criteria and the level of penetration in a particular application.

As per Lucintel, the future market is expected to be highly competitive and companies with innovative capabilities can thrive and gain market share. In the long-term, the composites industry is a sustainable market and it has excellent growth potential. The report indicates that in some regions of the BRIC countries, the usage of composites is mostly confined in the non-residential and industrial projects. Another challenge for the composite market is that it is affected by the short-term negative impact from global economic cues. Demand in aerospace and defense is expected to witness robust growth due to higher adoption of composites. Consumption of composites in automobiles have risen substantially, driven by fuel efficiency because of lighter vehicles for mass produced models as well as performance benefits to high-end automotive models. Pipe and tank is another market where composite materials are being used extensively. These applications may have huge impact on the growth of the composite industry over the next five years. The growth drivers overshadow the challenges substantially and hence, all BRIC countries are likely to witness robust growth during the forecast period. Most of them were impacted moderately by global economic issues; however, the impact was minimal when compared to the developed countries. |

|

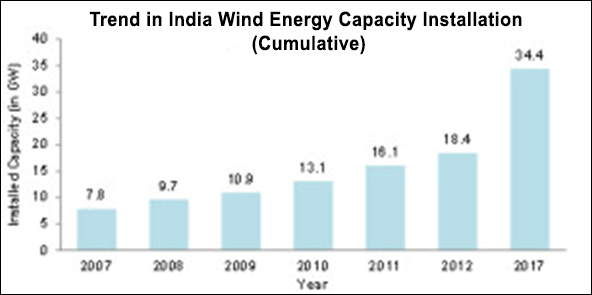

Wind energy industry is using composite materials extensively in wind blades to make the blades longer, lighter, and more efficient. Wind energy in India depicted tremendous growth in between 2009-2011, mainly driven by government incentive programs such as Generation Based Incentive (GBI) and Accelerated Depreciation (AD) benefits. During the 12th five year plan (2012-2017), India is expected to add 15,000 MW of wind energy capacity. Transformation of mass transit system in India from traditional vehicles to metro/mono rail, high speed trains, and rapid bus transport is expected create great demand for lightweight composite materials, in order to reduce the total system weight, increase speed, and achieve fuel efficiency. As per estimates, by 2021, India will add approximately 1,810 km of metro rail and 567 km of mono rail lines. Indian Railway also requires huge investment for the rehabilitation of old coaches to accomplish its vision of offering a world-class travel experience. Coach Rehabilitation Workshop (CRW) in Bhopal is working to develop model rakes for the rehabilitation of old coaches, where Fiber reinforced plastic (FRP) walls and panels will be used as prime material to provide aesthetics and comfort to passengers. The rehabilitation of old coaches will require a large volume of composite materials in the next few years. This is expected to offer immense opportunities for domestic as well as global giants to cater to the unique needs of the market. |

|

India is one of the largest defense equipment importers and expected to become third largest defense spender after US and China by 2014. The Ministry of Defense intends to increase the indigenous production of defense equipment to 70% from the current level of 30%. This indigenous growth prospect is expected to drive the domestic market for composite materials, also private-public partnership initiatives is expected to encourage new entrants in this market. Tejus, Indian lightweight combat aircraft (developed by HAL) employed up to 45% of composite materials and inter-continental missile Agni 5 employed more than 75% of composite in the project. Indian defense offset policy also expected to direct Indian towards a manufacturing hub for many global players in next few years. Fiber-reinforced composites are among the most preferred materials available today for replacement of traditional metals. The high strength to weight ratio, chemical and corrosion resistance, and superior aesthetic properties are the major characteristics which enhance the value proposition for end products made by this innovative material. The government spending, policy reforms, and incentive programs are the major driving factors for composites in mass transportation, infrastructure, renewable energy, and defense sectors. In the last few years, Indian composite industry witnessed the entry of many new suppliers as well many new products introduced in the market. The industry also stepped up to produce indigenous carbon fiber production with Kemrock’s 12k and 24k “Jaitec” brand. The composite material market in India looks attractive and is expected to retain its lucrativeness in the long run to offer promising growth for the investors of the sector. |

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}