| Polyurethane (PU) foams constitute the largest category of cellular polymeric materials. They are produced, for the most part, in either flexible or rigid form. Within these groups, the density and other properties vary depending on the end use. PU foams offer an attractive balance of performance characteristics (aging properties, mechanical strength, elastic properties, chemical resistance, insulating properties) and cost. Flexible PU foams are used primarily for cushioning and rigid PU foams for insulation. For some applications, foams that have some stiffness and some elasticity are produced; in the trade, these are called semiflexible or semirigid foams. Regionally, polyurethane foam demand is relatively close to production because trade is not economic over larger distances. Even within the United States and China, supply geographically follows demand very closely. However, in Europe trade in higher-valued foams and compressed foam rolls has increased significantly over the last few years.

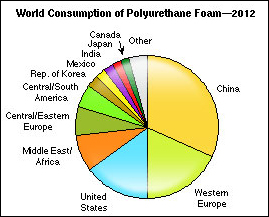

The following pie chart rom IHS Chemicals data shows world consumption of PU foam: |

|

As per IHS Chemicals, the major drivers for global polyurethane foam markets are regulation and energy efficiency (for rigid foam insulation); an increasing world population, particularly a rising middle class in the emerging markets (for flexible foam); and increased use for refrigeration (rigid foam). PU foam producers are challenged around the globe with manufacturing "greener" PU foams with improved sustainability and environmental characteristics - for example, polyurethane foams produced with bio-based polyols, rigid foams made with blowing agents with low global warming potential (GWP), and foams not using PBDE (polybrominated diphenylether) fire retardants. Many flexible PU foam producers and automotive seating manufacturers provide products made with bio-based polyols (the renewable content is widely varied). However, market penetration of "green" PU was still small in most of the global PU markets in 2012. During 2012 to 2017, consumption in the Americas is forecast to increase in line with GDP levels at an average annual rate of about 2.8%. Growth drivers are flexible foam for the transportation sectors (recovery of the North American automotive industry) and rigid foam for construction and refrigerator/freezer markets. The latter market will see growth primarily in Mexico and only to a lesser extent in the United States and Canada. During 2012, Western European polyurethane markets were negatively impacted by economic insecurity caused by the debt crisis in southern European countries, which was triggered by the crisis in Greece. Projected growth rates in Western Europe might be reached, but only if this state debt crisis is resolved in the foreseeable future. After the global recession of 2008–2009, Chinese markets recovered as a result of the Chinese government stimulus plan to encourage domestic consumption. The Indian polyurethane foam market is fast-growing for uses such as insulation for construction and refrigeration, as well as for flexible foam for car seats and two-wheeler seats. The production of flexible foam accounts for the largest share of the Indian polyurethane industry. PU foam markets in Japan have been at essentially the same level for many years. Japanese foamers have actively participated in developing environmentally friendly products by adopting CO2 foaming technology to improve their competitiveness and sustainability. A spike in consumption was seen for automotive uses in 2012, but consumption is expected to return to more normal levels, leading to an apparent consumption decline in 2012–2017. The global polyurethane foams market in 2012 was pegged at US$40.1 bln and is estimated to reach US$61.9 bln by 2018, growing at a CAGR of 6.9% from 2013 to 2018, as per MarketsandMarkets. The high demand across the industries, such as bedding & furniture, building & construction and automotive will increase the overall Polyurethane foam consumption. The global polyurethane foam types are significantly penetrating their end-user industry market. These have different characteristics as per the manufacturing and their application requirement in the end products. The Asia-Pacific market is expected to dominate with its growing demand for polyurethane foams in different applications especially bedding & furniture, and building & construction. The Western European and North American markets are expected to show a rising growth in the next five years with allied industries expected to stabilize the overall business need in the respective regions. R&D is a key part of this market where manufacturing companies, associations, and end product makers infuses high investments for future advancements and technology modifications of polyurethane foam to match new demands coming from various end-user industries. Polyurethane foams are dominant in consumption and revenue made, reasoned by its optimal cost to performance factor. Asia-Pacific is the largest region, both in terms of volume and value, followed by Western Europe and North America. China, Japan, U.S., Germany, Brazil, and Russia are expected to persist as successful foam markets. Eastern and central European nations, emerging South-East Asian and Latin American nations that host global events would supplement the growth of polyurethane foams. An increase in auto sales, proposals for improvement of infrastructure, and rising housing market in emerging economies will drive the polyurethane foam market. The major players in the global polyurethane foam market are Armacell LLC (Germany), BASF SE (Germany), Bayer MaterialScience AG (Germany), British Vita Foams plc (U.K.), Carpenter Co. (U.S.), Chemtura Corporation (U.S.), Huntsman Corporation (U.S.), Recticel S.A. (Belgium), Rogers Corporation (U.S.), The Dow Chemical Company (U.S.), and Woodbridge Foam Partner (U.S.). |

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}