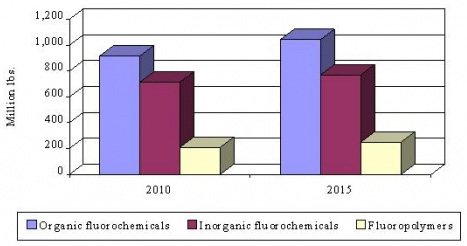

| The U.S. performance fluorochemical and polymer markets in 2010 were estimated at approx 1.8 bln lbs pounds. This is expected to reach nearly 2.06 bln lbs in 2015 at a compound annual growth rate (CAGR) of 2.3% for the 5-year period to 2015, as per BCC Research. Organic fluorochemicals account for the highest market share and are expected to grow from 917 mln lbs in 2010 to over 1 bln lbs in 2015 at a 2.6% CAGR. Inorganic fluorochemicals have the second highest market share and are expected to grow from 714 mln lbs in 2010 to over 770 mln lbs in 2015 at a 1.5% CAGR. U.S. Overall Performance Fluorochemical And Polymer Markets Estimates, 2010 And 2015 (mln lbs)  Source: BCC Research As per another report by Freedonia, US demand for fluoropolymers will rise 4.5% pa to US$1.7 bln in 2013. Gains will represent acceleration from the 1998-2008 decade, during which the fluoropolymer market was hampered by weakness in the manufacturing sector. Going forward, demand for fluoropolymers will be driven by a turnaround in key markets such as motor vehicles and wire and cable, and the increasing need for high-performance materials in demanding industrial applications. Rising demand in emerging, fast-growth markets such as advanced batteries, fuel cells and photovoltaic modules will also support gains. Polytetrafluoroethylene (PTFE), the first commercial fluoropolymer, will continue to account for the largest portion of demand in 2013. Advances for PTFE will be driven by growing opportunities in applications such as chemical processing and industrial filtration. However, the most rapid gains will be seen for fluoroelastomer products, fueled by a strong rebound in motor vehicle production from a low 2008 base. Demand for fluorinated ethylene propylene (FEP) and polyvinylidene fluoride (PVDF) resins will rise at a more moderate pace, limited by a drop in nonresidential construction activity. Nonetheless, gains for these resins will exceed 3% pa by volume, easily outpacing growth in real manufacturing activity over the same period. Robust gains will be also be found in smaller-volume fluoropolymer products, which include a number of high value materials used in emerging markets. Double-digit growth in solar energy products will fuel gains for polyvinyl fluoride (PVF) films used in the production of photovoltaic modules. Demand for perfluorosulfonic acid polymers will be driven by the rapid rise in fuel cell shipments. Additionally, a strong pharmaceutical market will bolster demand for polychlorotrifluoroethylene (PCTFE) polymers, which are used in drug packaging films. Industrial markets will remain the largest outlet for fluoropolymers in 2013, accounting for about one-third of demand by value. The increasingly aggressive and corrosive processes used in chemical and semiconductor manufacturing will spur growing demand for high-performance fluoropolymer materials. The fastest gains, however, will be in transportation equipment markets, driven by a rebound in motor vehicle output and increased penetration of fluoroelastomer products. Electrical and electronic markets will also see above-average gains in demand, led by the small (but rapidly expanding) fuel cell and photovoltaic segments. As per a report by Taiyou Research, demand for fluoropolymers is anticipated to rise by 4.5% pa to over US$2 bln by 2015. Rising demand in emerging, high-growth markets such as advanced batteries, fuel cells and photovoltaic modules will also support gains. Polytetrafluoroethylene (PTFE), the first commercial fluoropolymer, will continue to account for the largest portion of demand in 2015. However, the most rapid gains will be seen for fluoroelastomer products, fueled by a strong rebound in motor vehicle production from a low 2008 base. Demand for fluorinated ethylene propylene (FEP) and polyvinylidene fluoride (PVDF) resins will rise at a more moderate pace, limited by a drop in nonresidential construction activity. Fluoropolymers remain constantly in demand due to their durable nature and applications in various other places. Industrial markets will remain the largest outlet for fluoropolymers by 2015, accounting for nearly one-third of demand by value. Double-digit growth in solar energy products will fuel gains for polyvinyl fluoride (PVF) films used in the production of photovoltaic modules. |

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}