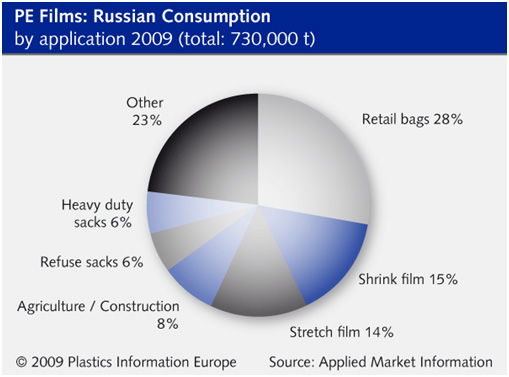

There is a great potential for growth in the PE film industry in Russia, as per AMI. The industry structure in Russia is fast changing as the country develops from the chaotic early period of privatisation in the 1990s and the breakup of the former Soviet industrial complexes. Most of the significant film producers today are new companies which have been set up since the end of the Soviet era, although some of the former Soviet operations do still exist. 240 companies represent around 80% of film production in Russia. Despite the current economic slowdown, demand for film production will continue to grow significantly in the future as Russia offers a massive potential for development particularly in the packaging sector. There will be growing demand for more sophisticated plastics packaging driven by the increasing presence of multinational food processing groups and supermarket companies which will compete strongly with local Russian brands. This competition and changing consumer demands will be a stimulus for the development of plastics film packaging. There has been particularly spectacular growth in PE stretch film and multilayer film production. These film types were not produced under the Soviet regime and it is only recently that investments have been secured for their manufacture in Russia. These investments are leading to a shift in the structure of polymer demand for film production In the Soviet era LDPE was the main feedstock, reflecting local availability and lack of multilayer equipment to process linear types. LDPE is still the main material used in film production but linear resins are continually increasing their market share. Apart from some volumes of polyethylene film which are used for agricultural and building applications, nearly all the major end use markets are in some form of packaging, principally for food products.

More and more Russians are doing their grocery shopping in supermarkets. At the same time, their needs are being redefined with the expanding possibilities. The twin objectives of keeping food fresh longer and avoiding transport damage is promoting the use of coextruded barrier film. The trend to urbanisation and the mounting prosperity of the population are also encouraging consumption of snacks and ready-to-eat meals. Manufacturers of PE film in Russia are extremely difficult to identify. The industry is still very much in a state of flux. Rampant corruption, for example, led to the founding of many companies that never even began production. The market research company lists 230 companies that it says account for around 80% of Russian production. At the same time, it cautions that other estimates put the number of firms engaged in film extrusion at several thousand. Film manufacturers for the most part are scattered throughout the eastern provinces and the republics of the Russian federation. The largest volumes are produced in and around Moscow as well as in the provinces of Nizhny Novgorod, Samara and Rostov. In the Republic of Bashkortostan there is also a major integrated film manufacturing facility. In all, some 60% of Russia's total volume of PE film is produced in these regions. The most important film manufacturers were founded after the end of the Soviet era, to manufacture products that were previously inaccessible. The largest stretch film manufacturers according to AMI are VarioPak (St Petersburg), Regent Stretch (Moscow), Nova Roll (Moscow) and Lava (Vyazma). As concerns film products generally, NTL Upakovka (Saint Petersburg), Novatek (Novokuybyshevsk), Interpack (Nizhny-Novgorod) and Polymer (Desnogrorsk) lead the market. Despite the deterioration of the market due to the economic crisis, manufacture of PE film in Russia will continue to increase in the next five years. Following a poor 2009, the Russian economy as a whole should begin growing again in 2010, by 3-4% a year. This could mean the postponement of some new production facilities and capacity expansions, but at the same time, local producers will profit from the weak rouble, which will make imports more expensive. In addition, the country has a per capita consumption of PE film totalling just 5 kg compared with an average of 16 kg in Europe, so there is still considerable potential for growth. The Russian market of plastic film, despite the efforts of key players is unable to move from quantitative growth to qualitative development. This was discussed at an international conference of "Creon" Polymer films. Despite the general mood of optimism in the industry, and recent growth in investment and consumption, several issues associated primarily with raw material supply and demand structure of the film, persist. As per Deputy Director General for Development and Marketing, "NTL Package" Alex Chubykin, the consequences of the crisis and the collapse of the market in 2009 are still being felt, although the volume of demand has recovered. However, the industry has no understanding of what direction to grow and where to concentrate investment resources. This became especially important after the huge decline in consumption, which resulted in a shortage of working capital for market players. In 2010, a particularly high growth in demand seen in the markets is relatively new to Russia, BOPP and PET films. At the same time, the market of these films is controlled by only three companies and the emergence of new players is unlikely to happen soon. The total volume of production of BOPP films in Russia is estimated at 120,000 tpa, the market has strong presence of Turkish and Chinese companies, with expectation of BOPP film imports from Turkmenistan. High barrier film projects have not yet been successfully implemented in Russia because of limited demand. In general, polypropylene film, although still a niche product, is gradually being replaced by cheaper polyethylene. Overall market growth forecast for 2011, according to Mr. Chubykin looks very optimistic. Capacity of the Russian market of BOPP in 2010 amounted to 120,000 tons by end of 2011, projected to increase to 135,000 tons. According to forecasts by Mrs. Malkova, 2015 the consumption of BOPP films in the Russian market will be about 200,000 tons. Another change in recent times has been the reduction of exports, and increased dependence on the domestic market for raw material. However, according to CEO of Isratek Michael Shulyakova, the polymers from Moscow and Tomsk are very inferior in performance than output from new plants Stavrolen and NKNKh. Problems of raw material supply industry occupied a special place in the Director General's report "KvadroKom" Alexander Sumatohina. According to him, the trading company of the firm is increasingly becoming productive, but still focuses mainly on "rewind" of the Chinese stretch of the films. Because of this, the company entered into conflict with local players in the market due to the loss of the last big order. At the same time, Russian companies are unable to offer a competitive product due to lack of stability in Russia the production of linear polyethylene. In Russia the corresponding raw material produces only NKNKh, but his work is unstable. |

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}