| 2010 saw a recovery in demand for most thermoplastics, after two of the worst years the European plastics Industry has seen since the oil shocks of the 1970s. According to AMI, after a drop in demand of over 15% over the period of the recession, volume demand showed a modest 4% recovery in 2010 bringing total demand to just over 37 mln tons. The market has been driven by a strong recovery in German-speaking Europe and by a reversal in the fortunes of the automotive industry, which had been one of the sectors hardest hit by the downturn. This was evidenced by a sharp bounce back in demand for engineering polymers which had tended to see the highest percentage drops in demand. While most sectors reported continuing growth in H1-2011, by mid-year signs of a slowdown were beginning to emerge and full year is expected to pan out at about half the rate achieved in 2010 and only slightly ahead of GDP. The recovery has in general been erratic and patchy and means that overall the European market still has some way to go to regain all the volumes lost from the 2007 peak when the market reached over 41 mln tons.

The recovery in demand over the past two years has also at times been challenged by issues around availability of raw materials and pricing volatility. In addition to polymer prices rising on an almost constant basis from December 2009 through to June 2011, because of increasing feedstock costs, converters have also had to contend with record high prices and severe shortages for a whole range of pigments and additive materials used in plastic products. The European plastics industry operates as part of a global industry which is heavily influenced by buying patterns around the world. Booming demand in Asia, particularly in China, but also in Russia and India, sucked raw materials away from European markets. Supply was further constrained by delays in new polymer capacity coming on stream in the Middle East and cutbacks in capacity within Europe, various plant outages caused by feedstock shortages and strikes (in France) which all contributed to periods of tight supply through 2010 for various materials but particularly grades of LDPE, PP and polystyrene. While certain applications regained nearly all the volumes lost through the effects of the destocking and low consumer confidence seen in 2009, others are witnessing more fundamental structural changes which have impacted their demand trends. Trends in light weighting, recycling, environmental and sustainability issues continue to challenge plastics usage in a variety of applications, but particularly in packaging. PET, for example, is seeing much slower growth now even though there are still lots of developments in new markets and applications e.g. in beer and wine packaging, because of growing availability of recycled PET, constant drives to reduce bottle weights and changing consumer drinking patterns.

The recession and its recovery has also brought about a reversal in fortunes for some countries. Whereas a few years ago Germany was seen as a mature, slow growing market with its plastics processing industry moving into Central Europe, the strength of its manufacturing industry and economy is now the engine for growth in Western and Central Europe. The bright prospects expected for Europe's Southern countries, Spain, Portugal, Italy and Greece, have now all faded away in the face of bursting asset bubbles and massive government deficits. Growth in plastics processing in these markets, if there is to be any, will mainly be driven by manufacturing exports as local building and consumer markets remain weak.

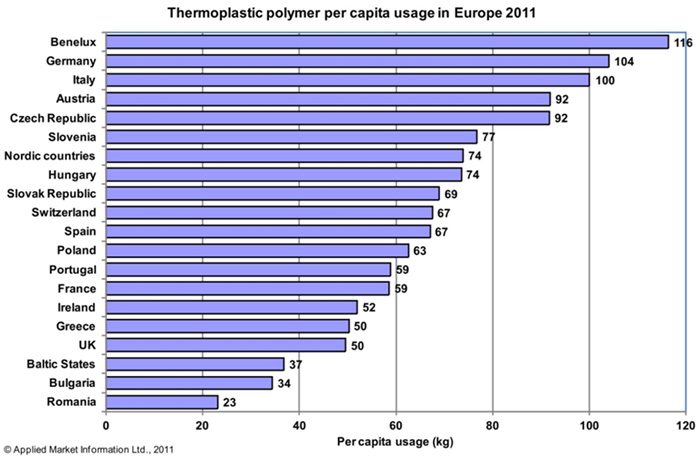

Another impact of the downturn has been a shrinking in per capita demand of thermoplastics (based on plastics conversion, rather than the demand for plastic goods). Per capita use of polymer in 2011 stands at just short of 74kg/head compared with over 82kg/head in 2007. As would be expected levels are generally higher in Western Europe than in Central Europe, although countries such as the Czech and Slovak Republics, Slovenia and Hungary are now higher than many West European countries highlighting the shift eastwards of polymer consumption. UK now has the lowest level of per capita demand for thermoplastics in Western Europe highlighting the decline in plastics processing that has occurred there over the past decade. The Benelux region continues to have the largest per capita consumption largely because of the presence of some major export-oriented processors in plastics film, fibre, compounds and masterbatch.  For 2011, AMI expects that polymer demand growth will stay slightly ahead of GDP growth at just over 2% bolstered by the stronger demand achieved during the first half of the year to counteract the weakening sentiment in the second half of the year. The growing maturity of the plastics processing industry in Europe means that future growth will increasingly be pegged to GDP. After experiencing difficult times during the downturn, petrochemical producers are now focusing on attaining both economies of scale and geographic expansion to gain a competitive advantage. The petrochemicals industry has entered a transitional phase after the global economic slowdown in 2008-2009 severally affected the growth of the industry. As per GlobalData, petrochem producers are seeking to create a presence in demand-rich geographies and are diversifying their portfolios to achieve higher growth rates. This has led to an increase in the number of partnership between companies of different regions. Since European and North American producers are grappling with declining demand, they are setting up joint ventures with Asian or Middle Eastern companies to sustain their profit margin. In the recent past, the majority of joint venture deals have happened in the Middle East and Asia Pacific. The growing Chinese demand provides opportunities for producers from other regions to utilize this demand by setting up joint ventures with Chinese companies. The Middle East has also become an important destination for petrochemicals production. The Middle East governments provide subsidies on the feedstocks used for petrochemicals production which makes production significantly cheaper compared to other regions. This has made it difficult for producers in other regions to compete. To deal with this situation, companies from other regions are increasingly partnering with the Middle East companies to gain a cost advantage. Joint ventures in these two regions are expected to increase in the next five years as many of the planned projects in these regions are established under joint ventures. |

11-Oct-23

Potřebujete finanční pomoc? Jste podnikatel? Jste v obtížné finanční situaci? Nebo potřebujete peníze, abyste mohli začít svůj vlastní podnik? nebo placení účtů nebo placení za dům, auto? Zájem o online finanční pomoc? Potřebujete důvěryhodný soukromý věřitel s osvědčenými zkušenostmi? Pokud ano, kontaktujte mě e-mailem: Veronikajirikova10@gmail.com whatsapp.....+420704207735

01-Oct-23

Nabízíme nejrychlejší půjčky. Žádat můžete od 30 000 Kč do 500 000 000 Kč. Splátky si můžete naplánovat na několik měsíců nebo až na 30 let. Vaši žádost zpracujeme a schválíme téměř okamžitě. Peníze vyplácíme v den podpisu smlouvy. Vše vyřídíte z domova, aniž byste museli chodit do kanceláře. Pro více informací nás kontaktujte emailem. E-mail: tyrnerjan75@gmail.com

25-Oct-21

Wow, Thanks a lot guys for referring D e nnis ... I contacted him because I had a ba d cre dit sc ore of 490 and he fixed it is a short period of time at an aff ordable rate he raised it to 820 ... I am so happy and thankful for what he did for me... DENNISDFIXER at gm ail. com or +1 9 1 7 7 2 2 6 9 1 3 if you need his servi ces.

29-Aug-21

Earlier this year I had a really bad c r e d I t and also debts hovering around until I got in contact with Dennis Walker, I must say he is really the best I have come across on what he does which was clearing out my debts and raising my score up to 830 from 490..do well to write him if ever in need of such job.. dennisdfixer at g m a i l . c o m

03-Aug-21

Have you been looking for who will get the job done? without excuses or unplanned occurrences? Get in touch with Dennis Walker now, the only genuine one I have come across. If you are needing your score increased, BK removal etc then reach him on dennisdfixer at gmail dot com or nine one seven. Seven two two. Six nine one three..

19-Jan-19

Dear Sir, I am contacting you in regards of the gold business relationship which i would like us to work together to accomplish. Our family are into gold mining and we are direct owner of Alluvial Gold Dust/Gold Bar which We have for sale and we are looking for serious partners/buyers who have interest in punching our, AU GOLD-DUST/BAR and our family are willing to work with you if you are interested in doing business with us. If you can connect us to buyers we are going to pay you good commission per any kilo that your buyer purchase from our seller. We would also like to meet you in person, so we can negotiate and share better ways on how we can finalize the transaction. I am looking forward in reading from you, hope in getting in good relationship with you. MY PRIVATE EMAIL: kofogahanagold@yahoo.com kofogahanagold@yahoo.com kofogahanagold@yahoo.com Sincerely Yours. (For the family). Available at the moment: Commodity: Au Gold Bars Weight:Before And 1kg Bars Origin: Ghana Quantity In Stock: 2 Metric Tons Tranches: Trail Order 1,000kg Type:Au Gold Bars Purity.Finess: Based On 94% Quanlity: 22+ Carat Price: $3,2000 Per Kg Product History: Clean,Clear No Liens And Non-Criminal Origin Subsequent Supply Based On Buyer's Capacity Point Of Assay: Any Oof The Recognised Government Refineries Or As May Be Agreed SUPPLY OF AU GOLD DUST/BAR

19-Sep-17

Inquiry on purchase of Virgin raw materials homo pp HPIG110 and HDPE.