|

A new report from leading industry experts, AMI Consulting, highlights

the emergence of China as a major market for thermoplastic masterbatches.

Despite the economic recession which engulfed much of the rest of

the South East Asian region during 1997-1998, the Chinese economy

continued to forge ahead, resulting in strong demand and production

growth for masterbatch products.

In the year 2000, masterbatch production in China accounted for

33% of the total production in the South East Asian region and the

Chinese market accounted for 35% of all masterbatch demand. Thus,

China has surpassed South Korea as the leading

masterbatch producing nation in the region, and is on course

to become the largest country market in the world. Demand has grown

from just under 89,000 tonnes in 1990 to nearly 300,0000 tonnes

by 2000, which amounts to year on year increase of around 13%. Increases

in production capacity have been equally impressive and in 2000

the region produced over 250,000 tonnes of masterbatch products.

This growth has been fuelled by the increasing levels of investment

in plastics processing, which are often set up by foreign-owned

investors to supply European or Japanese customers, and who specify

the use of masterbatch products. Growing local demand has also seen

a comparable increase in masterbatch production, again often involving

foreign companies.

Despite the financial crisis of 1997-1998, the South East Asian

masterbatch market has been one of the most dynamic and fastest

growing in the world. In addition to the growth in plastics processing

in China, there has also been substantial investments in other countries

such as Thailand and Malaysia, and the region has generally seen

a rapid uptake in the use of masterbatch through the 1990s.

The region therefore is a net importer,

although obviously there are marked variations between the import

requirements of individual countries and within each of the main

masterbatch types. The region is actually a net exporter of white

products but has a substantial import requirement for additive and

coloured types.

South Korea, Singapore and Philippines all have a trade surplus

in masterbatch products, while Taiwan and China have substantial

net trade deficits in masterbatch.

Despite continued investment in new production capacity over the

next five years, the region will continue to import more than it

exports, and the level of imports will increase at a greater rate

than exports. Opportunities for non-Asian companies to supply into

the region will mainly occur in the colour and additive area.

South East Asia represents a highly diverse

market for masterbatch products, with the individual markets

within it ranging from the highly sophisticated and well developed

such as in Singapore to the small, but rapidly developing such as

Vietnam. Markets are also very different in their adoption of masterbatch

usage, with some countries continuing to have a significant use

of dry pigments and compounds while others use masterbatch to a

greater extent. Methods of colouring used by processors vary, depending

on tradition, costs and availability.

There are though a number of factors working

in favour of masterbatch and contributing to its growing use,

like

|

|

Many plastics processors in South East Asia are supplying

to Western or Japanese OEMs who will have a very tight specification

in terms of colour match and performance. Often these companies

will tell the processor which masterbatch to use. |

|

|

Even if a processor is not directly supplying to a multinational

OEM, many within South East Asia supply to export markets in the

West and therefore need to manufacture to the standards and quality

that these markets demand, which would again often favour masterbatch

use. |

In the future the trends observed

in the late 1990s will be further reinforced.

|

|

By 2005, China will have assumed even greater importance, accounting

for nearly 50% of production. Thailand is also expected to see its

output increase substantially and new production capacity is expected

to emerge in Vietnam. |

|

|

Similar trends will also be observed in the consumption of masterbatches

throughout the region. The Chinese market is expected to increase

by over 150% over the period 2000-2005 and will account for 47%

of the market share. |

Although all other countries are forecast to grow strongly over

this period, they will be left behind by the dynamism of the Chinese

market. Chinese demand is forecasted to grow at over 20% per year

over this five year period, whereas most other markets will be developing

at around 7-8 %.

| (Source:

Plastics News International) |

Previous Article

Next Article

Tell Us What You Want

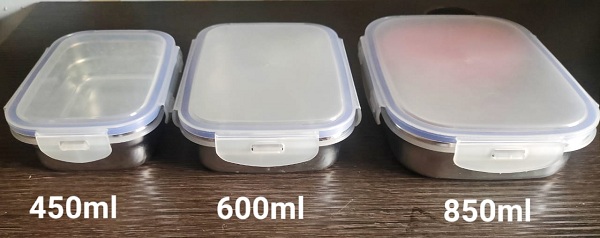

Unused tiffin, lunch box moulds

| | | |