|

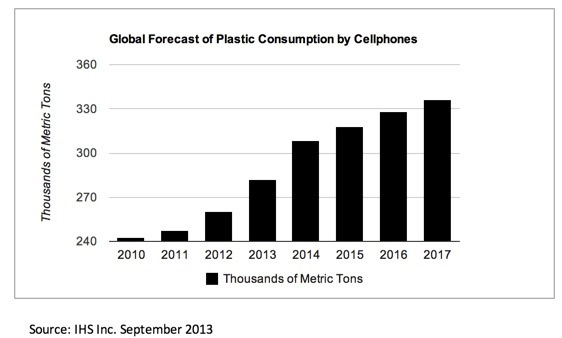

The market for molded plastic components for phones will rise rapidly in the coming years, as per IHS Consulting. The market is already predicted to touch US$3.5 bln this year, up slightly from last year’s US$3.3 bln. In the coming years, though, the plastics market for phones is expected to hit US$4.5 bln by 2017, a full 27% increase over four years. The total weight of plastic resin used in phones in 2017 is expected to be 336,000 metric tons. “Plastic components are becoming increasingly important in mobile handsets, and especially in smart phones,” said Kristin Squires, a consultant at IHS. “Amid rising competition in the market, smart phone original equipment manufacturers (OEM) are seeking ways to drive down costs for raw materials, manufacturing and assembly. Plastic offers multitude ways to cut these expenses.” Polycarbonate enclosure of the new iPhone 5c weighs just 14.2 grams, as per Jagdish Rebello, senior director for Consumer & Communications at IHS. “With 20 million iPhone 5c smartphones forecast to be sold through the rest of 2013, this represents a total consumption of 283 metric tons of polycarbonate resin by just one device, in just one quarter. With the introduction of the 5c, Apple now is part of a rising wave of plastic in the smartphone market - and in the overall electronics business. ”Apple’s decision to use plastic for the 5c’s enclosure was partly driven by a desire to offer a lower-priced smartphone that cost less to manufacture than previous members of the iPhone line. Plastic also allowed Apple to offer iPhones in a greater variety of colors than ever before. This push toward reduced cost and greater product differentiation reflects a larger trend in the cellphone market. “Plastic components are becoming increasingly important in mobile handsets, and especially in smartphones,” said Kristin Squires, chemicals industry consultant with IHS. “Amid rising competition in the market, smartphone original equipment manufacturers (OEM) are seeking ways to drive down costs for raw materials, manufacturing and assembly. Plastic offers multitude ways to cut these expenses.” Meanwhile, OEMs are attempting to differentiate their products by creating smartphones that are aesthetically appealing to their consumers. Plastics components allow for a great deal of design flexibility as well as product and functional differentiation. OEMs are using a plastic resin called acrylonitrile butadiene styrene (ABS), along with polycarbonate and ABS/ polycarbonate blends. By using these plastics in the product housings, the OEMs can offer lightweight products that are visually attractive to customers. Rebello agrees. “The well-designed plastic housing allows Apple to easily offer the iPhone 5C in a range of colors, and provides Apple with tremendous manufacturing and assembly cost savings in terms of simplifying the assembly of the final product,” he added. “The precision-machined metal housing in the iPhone 5s—as well as the earlier-generation iPhone 5 - requires significantly higher machining tolerances and assembly costs. Apple’s return to plastic casings shows that plastics are here to stay.”  The cell phone market offers opportunities for a large variety of plastic resins including ABS, polycarbonate, nylon and polymethyl methacrylate (PMMA). ABS and polycarbonate are both attractive materials for exterior components due to their strength and aesthetic appeal. Polycarbonate cell phone housing may have a chemical coating to improve its scratch-resistance. In addition to enclosures, plastics are used in a wide range of cell phone applications ranging from mounting brackets and display frames to display backlight guides, insulator sheets and vibration cushions. And as low-end smart phones start to become increasingly adopted in the emerging markets of the world, IHS projects that plastics will increasingly be used for a wide range of mechanical and optical components in the mobile handset and smart phone market. IHS forecasts that ABS and polycarbonate demand for cell phone components will grow at compound annual growth rates of 7% and 4.5%, respectively, through 2017. The rising use of plastics in cell phones is part of a much larger trend of increasing utilization of the material in a wide range of electronic products, including consumer and computing devices like LCD TVs, PCs, printers and media tablets, and appliances such as refrigerators, washing machines and microwave ovens. IHS has determined that the electronics industry will consume nearly 16.0 million metric tons of plastic resin in 2017, up from 12.8 mln in 2012. |

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}