|

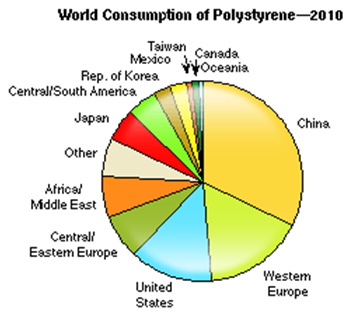

Polystyrene, a thermoplastic resin that is easily processed has many applications such as disposables, packaging, toys, construction, electronics and houseware. The different grades of polystyrene include: General-purpose (also referred to as crystal or straight) resin - in three common grades: high-heat, medium-flow and high-flow grades. High-impact resin is sold in high and medium grades, an environmental stress crack-resistant grade and ignition-resistant and high-gloss grades. These resins are formed into intermediates and/or final products via processes such as injection molding, extrusion and thermoforming.  Asia is the overall leader in production and consumption of polystyrene, with 53% of total world production and 47% of total consumption of polystyrene in 2010. North America and Western Europe follow distantly at about 17-19% of the total production and consumption each. Another dynamics of the global market has been the slow erosion of the domestic markets of mature countries and regions such as North America, Europe and northeast Asia (excluding China). In the United States, expandable polystyrene (EPS) in particular, has been hard hit with the influx of lower-cost imported resins. Through the recession, the percentage of imports of EPS resin relative to consumption rose from 40% to 44% over 2007 through 2010. As a result, domestic EPS manufacturers saw operating rates fall from 99% in 2006 to below 80% at the depths of the recession, severely impairing return on production assets, as demand for EPS actually held up fairly well in favored applications during the recession. Similar effects were also seen in Western European markets. A critical question is-will domestic converters continue to import resin or as local prices decline, will it be more favorable to buy domestic? Asian consumption of all types of polystyrene is forecast to increase at an average annual rate of slightly over 3% during 2010-2015, slowed by less than 1% annual growth in the developed countries of North east Asia, while North American demand is expected to decrease 0.5% and Western Europe will show only modest growth of 1.6% over the next five years. Global demand for polystyrene and expandable polystyrene increased from 13 mln tons in 2000 to around 14.9 mln tons in 2010. Demand grew at a CAGR of 1.4% during 2000-2010, as per GBI Research. Packaging, construction, appliances and consumer electronics industries were the major consumers of polystyrene and expandable polystyrene. Some of the major markets for polystyrene and expandable polystyrene (EPS) have reached a saturation point, which has limited the demand growth for polystyrene and EPS in those regions. The global demand for polystyrene and EPS is rising within developing countries such as China, India, Iran, Saudi Arabia and Brazil. In the forecast period 2010-2020, the global demand is expected to grow at a CAGR of 4.7%, to increase the overall demand for polystyrene and EPS to 23.5 mln tons by 2020. The Asia-Pacific region was the major consumer for polystyrene and EPS in global market in 2010, with a demand share of 53.4%. With the fast growing economy of China, Asia-Pacific dominance in the global polystyrene and EPS is expected to increase further, to achieve 62.8% of the global demand share by 2020. With growth in the developing countries of Iran and Saudi Arabia, the Middle East is expected to retain its demand share of 1.7% by 2020. Due to the comparatively slower demand growth from all other regions, their demand shares are expected to decline in the forecast period. The global polystyrene market saw a marginal net decline in demand over the past decade, whereas global EPS demand grew at a CAGR of 5.5% during the period 2000-2010. The major portion of this demand growth came from China, which attributed over half of the global expandable polystyrene demand in 2010. China’s demand for EPS is expected to continue to increase at a high rate over the forecast period, while other developing countries are expected to support the overall growth. Therefore, during the forecast period 2010-2020, the EPS demand is expected to increase at a CAGR of 7.3%, compared to polystyrene’s expected CAGR of 2.8% during the same period. Packaging was the dominant end-use sector for both polystyrene and EPS globally. The packaging industry consumed 41.5% of global polystyrene demand and 47.9% of global EPS demand in 2010. After packaging, the construction industry was the second major polystyrene consuming industry, accounting for 47.8% of EPS and 7.7% of polystyrene consumption at a global level, along with furniture and building industries. These two industries are expected to drive the global demand for polystyrene and expandable polystyrene in the forecast period as well. Packaging was the dominant end-use sector for both polystyrene and expandable polystyrene globally. The packaging industry consumed 41.5% of global polystyrene demand and 47.9% of global expandable polystyrene demand in 2010. After packaging, the construction industry was the second major polystyrene consuming industry, accounting for 47.8% of expandable polystyrene and 7.7% of polystyrene consumption at a global level, along with furniture and building industries. These two industries are expected to drive the global demand for polystyrene and expandable polystyrene in the forecast period as well. |

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}