|

Plastic additives market is estimated to grow on enhanced demand in construction, packaging, consumer goods and automobile industries till 2022, as per Grand View Research, Inc. Plastic additives are added to polymers to improve their performance, appearance and processability. The global plastic additives market, valued at US$38 bln in 2014, is estimated to grow at a CAGR of 5% from 2014 to 2019. This may be attributed to diverse application areas like construction, packaging, consumer goods, automobiles, etc.

Increasing population, rapid urbanization, and growing incomes are contributing to higher consumption of plastic, particularly in Asia Pacific. Presence of huge untapped market segments will open up future opportunities. However, demand will be adversely affected by strict environmental regulations in several parts of the world. The global plastic additives market is segregated on the basis of additive types, plastic types, applications and regions. Additive types include flame retardants, plasticizers, impact modifiers, stabilizers and others. Stabilizers are further split into heat stabilizers, antioxidants, and light and UV stabilizers. Others comprise nucleating agents, blowing agents, anti-microbial, fillers, fragrances, and anti-static agents. Plasticizers held about half of the total global market. Main plastic types are engineering plastics, high performance plastics and commodity plastics. Key application segments include consumer goods, packaging, automobile, construction, and others. Furniture, agriculture, sports, and pharmaceutical constitute others. Packaging and automotive will grow at the fastest rate over the next five years. Asia Pacific was the largest market for plastic additives in 2013. An expanding middle class coupled with infrastructural improvements is fueling regional demand. Latin America also has a strong construction sector. Both Asia Pacific and Latin America are getting urbanized. They are home to dynamic economies like India, China, and Brazil. This will positively affect growth. North America was next in line in terms of market share in 2013. It was followed by Europe.

Eminent players in the global plastic additives market are AkzoNobel N.V., Bayer AG, Albemarle Corporation, and BASF SE. Other noteworthy manufacturers include Clariant AG, Lanxess AG, and The Dow Chemical Company. The market is highly fragmented with the presence of several large and small companies. Level of competition is quite high and is expected to remain that way in the near future. Market participants are striving to introduce new products with improved quality and performance. Capacity expansions may be carried out in forthcoming years. Players would resort to price cuts to gain competitive advantage. Global plastic additives market size was estimated at 13.18 mln tons in 2014. Plastic additives are increasingly being utilized for varied functions that include property modifiers, extenders, stabilizers and processing aids in industrial applications. Additives such as antimicrobials, antioxidants, UV stabilizers, plasticizers, impact modifiers and others are largely used in compound formulations to improve chemical and physical properties. Rising industrial output and increased economic activity in emerging markets of Asia & South America is expected to drive the global industry over the forecast period. Regulatory bodies such as EC (Beaches European Commission) amended acts such as the Restriction on Hazardous Substances (RoHS) to regulate and control plasticizers, flame retardant and other additives owing to adverse effects on human health and environment. The U.S. FDA has formulated the Federal Code of Regulations, Title 21, Part 177 to regulate the types of indirect additives used in food contact substances. These requirements are a set of guidelines established to regulate maximum permissible additive quantities used in food processing and packaging applications. The global industry is characterized by volatile raw material prices coupled with stringent environmental regulations for manufacturing plasticizers, UV stabilizers and other additives. Political turmoil in the Middle East regarding petrochemicals is further expected to affect supply and pricing dynamics over the forecast period. Other products such as PC and PMMA are gaining importance especially as substitutes for glass. Growing emphasis on conductive additives such as carbon nanotubes and nanofibers has also been major factor for promoting them in electrical and electronic applications.

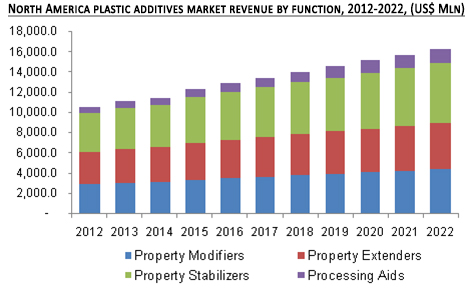

On the basis of function, the global industry has been segmented into property extenders, property modifiers, property stabilizers and processing aids. Property stabilizers were the leading segment and accounted for over 36% of the overall market volume in 2014. Property stabilizers are largely used in to increase stability in terms of chemical bonding, thermal and physical properties. The segment is expected to account for US$4341.4 mln by 2022, growing at 4% CAGR from 2015 to 2022. Processing aids are expected to register highest volume growth over the forecast period owing to its increasing application in enhancement of plastic extrusion ability. Manufacturers prefer these aids to improve quality and output of PE films, tubes, pipes and other finished products. This factor is expected to highly influence demand for processing aids over the forecast period. On the basis of product, global plastic additives industry has been segmented into plasticizers, flame retardants, impact modifiers, antimicrobials, UV stabilizers, antioxidants and others. Plasticizers were the leading product segment and accounted for 51.7% of the global market volume in 2014. Plasticizers are banned in various substances such as toys and child care articles owing to their carcinogenic nature by various agencies such as the European Union and the U.S. EPA. This product segment is expected to witness moderate growth owing to declining market share. Increasing regulations regarding workplace safety has fostered flame retardants industry growth. These products are increasing being utilized in manufacturing industries to prevent fire accidents and arson incidents, owing to their thermal efficacy and heat resistance. Regional markets analyzed in the report include North America, Europe, Asia Pacific, and Middle East. Asia Pacific was the largest consumer and generated revenue of US$15704.5 in 2014 which is expected to rise at 4.5% CAGR from 2015 to 2022. Increasing industrial output and economic growth in India, Indonesia, Malaysia and China is expected to drive regional demand over the forecast period. Other developed nations such as U.S., UK, Germany and France are also expected to generate high demand for plasticizers, UV stabilizers, flame retardants and other additives. North American industry is expected to grow at 4.1% CAGR and Europe at 3.9% CAGR in terms of market volume. The global plastic additives market share was dominated by integrated companies providing feedstock, final products and supplying them to end-user such as automotive, OEMs, construction, electronics and footwear among others. The market has presence of numerous producers who command majority of the overall share. Key players with global presence include BASF SE, SABIC, DuPont, ExxonMobil Chemical, Mitsui Chemical, The Dow Chemical Company and Biesterfield Plastic GmbH among several others. Technology innovation, product development and production optimization are crucial for industry participants to maintain competitive edge. There is also a considerable presence of integrated players who are involved in raw material and feedstock procurement along with plastic additives, as per Grand View Research, Inc..

The global plastic additives market is expected to reach US$64.6 bln by 2021, as per BCC Research. The growing market demand for products made of polyvinyl chloride has spurred demand for the plasticizers used in PVC formulation. BCC Research reveals that phthalates, the most widely used plasticizer, accounts for about 90% of the global market for plasticizers used in PVC production. Additives are vital for the mass production of plastic products. Not only do they improve the melting and molding properties of plastics, as well as their strength, stability and chemical properties, additives also protect plastics from losing their molecular properties to heat and high shear rates generated during the processing of plastics. Stabilizers and lubricants also help in the processing of rigid PVC, and antioxidants prevent the molecular structure of nylons from decomposing during molding.

The global market for plastics additives, valued at US$48.2 bln in 2015, is estimated to grow from nearly US$50.6 bln in 2016 to US$64.6 bln by 2021, reflecting a five-year CAGR of 5%. Property modifiers, the largest segment of this market, will grow from nearly US$27.9 bln in 2016 to nearly US$35.9 bln by 2021 with a CAGR of 5.2%. The next-largest segment, property extenders segment, will grow from US$9.3 bln in 2016 to US$11.9 bln by 2021 with a CAGR of 5.1%.

From 2002 to 2007, the plastics industry in developed countries experienced reduced profit margins, due to rapidly increasing feedstock prices, product life cycle maturity, loss of market share to emerging markets, and regulatory pressures. In 2007, the plastics industry regained some of its profitability; however, the global recession, in the second half of 2008, resulted in decreased production of plastics and subsequently a decrease in demand for plastics additives. These decreases continued through 2009. The plastics industry recovered in 2010 and subsequently so did the market for plastics additives. In 2014 and 2015, the plastics industry has regained its momentum and is poised for a greater future, which will further stimulate the plastics additives industry. An increase in the construction of homes and other building structures and new design trends in housing construction have increased the market for the most commonly used type of plastic, polyvinyl chloride, and subsequently has increased demand for plastics additives like the plasticizers used in PVC formulation. Additionally, sales of rigid PVC products are growing more quickly than flexible PVC, which is expected to increase the market for additives such as impact modifiers and lubricants. “Plasticizers are the most commonly used type of plastics additive, and their use is connected to the increase in the market for flexible PVC products. While phthalates are currently the most widely used plasticizer, phthalates with improved safety profiles will likely replace toxic compounds like diethylhexyl phthalate,” explains BCC Research analyst Srinivasa Rajaram. “The second most widely used additive, flame retardants, will experience very strong growth due to the surging electrical and electronics market. Phthalates account for a major portion of the plasticizers used.”

Additives are added in plastics to improve its impact strength, chemical and heat resistance, clarity, weather resistance and color preservation properties. They are used to add volume in order to control costs, modify the physical or chemical properties of the polymer, or reinforcing the polymer's mechanical properties to make it stronger and better for end-use applications. These are used in a variety of applications ranging from construction, packaging containers to consumer & electronics appliances, business machines and automotive parts. The market for plastic additives is estimated to grow on account of increasing disposable income especially in Asia-Pacific region and growing plastic consumption. The flourishing packaging application in emerging economies and increasing use of additives for agricultural and medical applications are expected to act as budding opportunities for this market. Region-wise, Asia-Pacific is estimated to be the leading plastic additives market. Growth in Asia-Pacific is led by the rising demand for plastics due to increasing population and improving standard of living of the people in the region. North America is estimated to be the second largest market for plastic additives and is projected to have a steady growth rate between 2014 and 2019. Packaging application is projected to have the biggest market of plastic additives as a result of rapid urbanization and increasing demand for packaging materials from consumer goods and food packaging industries. Commodity plastics segment is anticipated to have the largest market size in 2013 and will continue to dominate till 2019 on account of its economic commercial availability and wide-spread applications in several end-use industries. The plastic additives market is projected to register a CAGR of 5% between 2014 and 2019 to reach US$45.5 bln by 2019, as per MarketsandMarkets. The packaging application is anticipated to constitute a major part of the overall plastic additives market. The packaging and automotive segments are projected to witness a high growth rates between 2014 and 2019. The plastic additives industry is moving towards new product developments to expand their product portfolio to meet the different requirements of the end-use industries. |

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}