|

|

|

|

|

Ethylene makers in Middle East enjoy advantages in times of lower prices amid the economic slowdown |

|

|

| |

The olefins industry suffered a downturn of unprecedented severity in 2008, with the combined market for ethylene, propylene and butadiene contracting to 186 mln tons, from its peak of 196 mln tons in 2007 as per ChemSystems. The decline was due to record feedstock prices in the early part of the year, followed by a price collapse and loss of business confidence in the latter part of the year, which triggered industry wide de-stocking, and drastic cutbacks in production of olefins and derivatives. Demand for petrochemicals fell by 30-40% between July 2008 and January 2009, according to the American Chemistry Council.

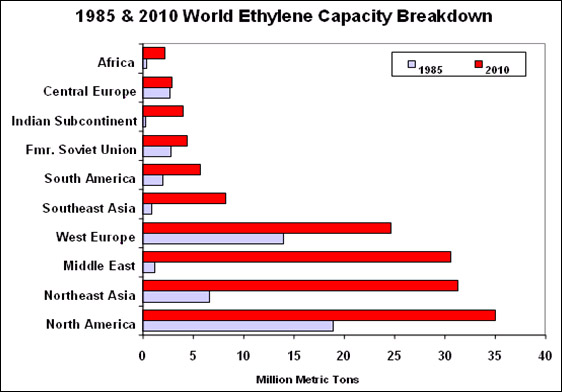

The massive buildup of ethylene capacity in the Middle East and Asia is progressing at a rapid pace and is sending the industry into another down cycle. From 1995 to 2008, ethylene capacity increased by more than 22 mln tons in Asia/Pacific, and by more than 13 mln tons in the Middle East. By 2015, these regions are projected to add an additional 41 mln tons of ethylene capacity. With a significant cost-advantaged feedstock base, ethylene production in the Middle East will rank as the most competitive in the world.

The industry is facing big challenges where huge capacities are going on stream in a time where prices have plunged. However, the feedstock cost advantage of the Middle East producer keeps them in a strong position compared with their European and US rivals. Despite falling profitability, Middle East companies are still in a good position to undercut competitors from other regions. At the moment, many regional companies are finding the market a tough one in which to operate, apparent by the Q1-09 loss recorded by Saudi Basic Industries Company (SABIC) of SR973 mln (US$260mln).

After Q1-09, optimism has grown as the key Asian economies show signs of recovery from the global economic downturn. As per MEED, In March and April, there was an increase in the volume of petrochemicals being traded in Asia and price recovery started in May. But, recovery has been limited as petrochemicals market is largely driven by demand for consumer goods in the West. Recovery in these countries has been shaky on leading to reduced demand. This has led many petrochemicals companies to cut production and, as of May 2009, an estimated 20% of the world�s crackers, which produce basic chemical feedstocks, were switched off. As per Chemsystems, there is a growing consensus that the bottom was reached in late 2008/early 2009, and that recovery is already underway, albeit slowly. 2009 GDP in most regions will average well below that of 2008, but the economic outlook, and thus demand drivers, are nonetheless improving from the desperate situation at the end of 2008. The consumption forecasts reflect a subsequent marginal recovery in 2010, followed by a period of strong economic recovery up to a peak in 2014. The polyolefin industry faces a massive capacity increase, at a time when consumption is considerably below expected levels. The bulk of the new investments are massive and highly advantaged plants in the Middle East. The rest are large and highly integrated plants in China, which benefit from optimised refinery/feedstock integration, low labour costs, and proximity to market. At the same time, large volumes of olefin and derivatives capacity are being shut down in mature, high cost regions such as Japan, Western Europe and the United States. Operators of high cost plants face a long period of oversupply, during which the installed capacity base will become substantially larger and more competitive on average. Some have already concluded that their plants no longer have a profitable future, and have closed them. Many others will do so over the next three years unless global operating rates improve from forecast levels. The outlook for the olefins business is therefore a prolongation of the current oversupply situation, with massive capacity additions outweighing consumption growth until 2013. Further closures of uncompetitive capacity are forecast, mainly in the United States, Western Europe and Japan. These regions will also lose their position as exporters of several olefin derivatives, and become net importers from the Middle East.

Middle East companies could still capitalise on the downturn, however, as they remain the world�s lowest-cost producers. The lower price of oil this year from its peak of US$147 a barrel in July 2008 to about US$70 a barrel in June 2009, has helped push the cost of natural gas to about US$4 a million BTUs on the open market. But Middle East companies can expect to pay closer to US$0.75-1.50 a million BTUs because of agreements with governments. This gives Middle East producers a cost advantage of US$300-350/ton over their Western rivals. The Middle Eastern petrochem producers also have much stronger balance sheets than the other major producers, devoid of debt. Most petrochem makers from the West have huge debts at a time of shrinking profits amid higher feedstock costs � This will lead to plant closures in the high-cost areas. European, US and Asian producers with access to high cost feedstocks will have to shut capacity down to help maintain prices and keep market supply in balance.

Large new petrochemicals projects will become increasingly rare in the Gulf as companies try to extend the capacities of their existing plants and struggle with the reduced availability of gas supplies. Simultaneously, ethane supplies are getting tighter as demand increases for gas as both an industrial feedstock and for power generation. Additionally, ethane can produce only polyolefins, while naphtha offers a much wider potential range, including styrene and polycarbonates, but has none of the cost advantages.

www.mees.com

| Asia Naphtha Vs Middle East Ethane |

| Asia Naphtha |

Middle East Ethane |

Middle East Cost Advantage |

| $/B |

$/Mn BTU |

$/Mn BTU |

| 20.00 = 3.40 |

0.75 � 1.50 |

2.65 � 1.90 |

| 30.00 = 5.15 |

0.75 � 1.50 |

4.40 � 3.65 |

| 40.00 = 6.80 |

0.75 � 1.50 |

6.05 � 5.30 |

| 50.00 = 8.55 |

0.75 � 1.50 |

7.80 � 7.05 |

This advantaged low-cost feedstock position leads to extremely low feedstock costs in a high oil price scenario. Feedstock prices vary by country, although the various countries in the Gulf region have basically adopted the same strategy, which is to provide feedstock at a price that provides a petrochemical producer with an incentive to invest (and attract new industry) while offering a better use/value for the hydrocarbon producer. This advantaged feedstock cost translates itself into the ability of a Gulf-based producer to manufacture and deliver polyolefins from a strong competitive cash cost position. |

|

| | | | | | |

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}