|

|

|

|

|

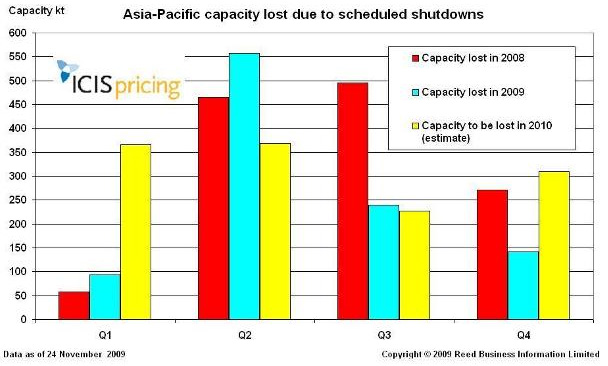

Heavy turnaround schedule planned at steam crackers in Asia for 2010 |

|

|

| |

Ethylene prices could rise in H1-2010 in Asia on tighter ethylene supplies anticipated in 2010 due to a heavy turnaround schedule at steam crackers. However, a possible increase in exports from the Middle East could help ease the strain on prices, as per ICIS. About 22 crackers would be shut for maintenance in 2010 compared with 15 taken off line this year. If the crackers in the Middle East have trouble next year, then there is some support for ethylene prices. The start-up of three new crackers in SE Asia by 2010 could lessen the impact from the heavy turnaround schedule as they will push down polymer and olefins prices and ease the tight balance in H2-2010. The key factor will be China�s insatiable appetite for petrochemicals and consumer goods that is anticipated to prevail into 2010 amid volatile swings in crude values and increased PE capacities within the country and from the Middle East.

Ethylene spot prices are near highest levels this year at US$1030-1070/ton CFR NE Asia in the week ending 20 November, mainly due to limited spot supplies and firm feedstock naphtha values at above $650/ton CFR Japan. Additionally, poor production rates in Iran (largest Middle East supplier of ethylene to Asia), have tightened availability of ethylene in 2009. Iran�s crackers were running at an average of 50-60% this year primarily due to cracker outages and lack of gas feedstock. Its ethylene exports were estimated to fall to 400,000-450,000 tons this year from 680,000-650,000 tons in 2008. Out of the 5.8 mln nameplate PE capacities from the Middle East projected from end-2008 through to 2009, less than 50% actually came into the market this year.

Ethylene spot prices are near highest levels this year at US$1030-1070/ton CFR NE Asia in the week ending 20 November, mainly due to limited spot supplies and firm feedstock naphtha values at above $700/ton CFR Japan. Additionally, poor production rates in Iran (largest Middle East supplier of ethylene to Asia), have tightened availability of ethylene in 2009. Iran�s crackers were running at an average of 50-60% this year primarily due to cracker outages and lack of gas feedstock. Its ethylene exports were estimated to fall to 400,000-450,000 tons this year from 680,000-700,000 tons in 2008. Out of the 5.8 mln nameplate PE capacities from the Middle East projected from end-2008 through to 2009, less than 50% actually came into the market this year.

PE producers in Asia, particularly in Malaysia and Thailand, are not very optimistic about polymer values as the removal of import tariffs within the region from January 2010 could cause price pressures due to more competition. Demand is beginning to wane as some buyers are waiting until January to make their PE purchases.

Cracker Turnaround Schedule 2010 |

| Company |

Location |

Capacity (tpa) |

Shutdown dates |

| PTT |

Mab Ta Phut, Thailand |

460,000 |

Jan-Feb |

| Sanyo |

Mizushima, Japan |

470,000 |

mid-Feb to mid-Apr |

| * LG |

Yeocheon, Korea |

900,000 |

3 Mar-8 Apr |

| Showa Denko |

Oita, Japan |

675,000 |

13 Mar-26 Apr |

| Tosoh |

Yokkaichi, Japan |

527,000 |

14 Mar-16 Apr |

| Maoming |

Maoming, China |

380,000 |

Mar-Apr (TBC) |

| Keiyo Ethylene |

Chiba, Japan |

740,000 |

May-Jun |

| Mitsui |

Osaka, Japan |

450,000 |

Jun-Jul |

| Mitsubishi |

Kashima, Japan |

375,000 |

Jun-Jul |

| ** BASF-YPC |

Nanjing, China |

600,000 |

H1 2010 |

| *** CNOOC- Shell |

Huizhou, China |

800,000 |

H1 2010 |

| YNCC |

Yeocheon, Korea |

400,000 |

17 May-20 Jun |

| Tonen |

Kawasaki, Japan |

515,000 |

Aug-Sep (TBC) |

| Formosa |

Mailiao, Taiwan |

1,030,000 |

Sep-Oct |

| Mitsubishi |

Kashima, Japan |

453,000 |

Jul-Aug |

| YNCC |

Yeocheon, Korea |

850,000 |

4 Oct-2 Nov |

| SK Energy |

Ulsan, Korea |

690,000 |

4 Oct-4 Nov |

| CPC |

Linyuan, Taiwan |

385,000 |

Nov-Dec |

| Rayong Olefins |

Mab Ta Phut, Thailand |

800,000 |

Q4 |

| Titan |

Pasir Gudang, Malaysia |

300,000 |

H1 2010 (TBC) |

| Titan |

Pasir Gudang, Malaysia |

440,000 |

H2 2010 (TBC) |

| Yangzi |

Nanjing, China |

650,000 |

H2 2010 (TBC) |

| Source ICIS |

* LG Chem will debottleneck the cracker to 1 mln tpa.

** BASF-YPC�s cracker capacity is expected to be increased to 740,000 tpa.

*** CNOOC-Shell plans to expand the cracker capacity to 1 mln tpa.

|

| | | | | | | |

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}