|

The flexible packaging market is considered to be one of the most dynamic packaging markets exhibiting diversified types of packaging and materials used across the regions. A report by Markets and Markets estimates the global flexible packaging market to grow at a CAGR of 5.1% from 2013 to 2018. Food, beverage, personal care products and pharmaceutical industries are the most important constituents of consumer packaged goods. Food packaging dominates the market share in terms of value as well as volume. With a huge market potential and growing consumer preference, the market is likely to witness substantial growth in the coming years. In the current packaging environment, flexible packaging is an important packaging solution for a saturated industry. It plays a vital role in protecting and extending the shelf life of end-products. Depending on the characteristics of the end-product and value to be offered by packaging, the selection of resins and packaging type is decided. The right packaging type is essential to preserve the end-products such as food, beverage, personal care products and pharmaceuticals and prevent untoward chemical reactions endangering the consumer’s health. Hence, an efficient and suitable packaging solution is imperative for every product. The companies enjoying substantial market share are Amcor Ltd. (Australia), Sealed Air Corporation (U.S.), Bemis Company Inc. (U.S.), Mondi (South Africa), Huhtamäki Oyj (Finland) and Sonoco Products (U.S.). Key industry players are increasing their business and consolidating their presence by pursuing mergers and acquisitions in potential markets. Top six players in this global packaging industry held a market share of around 58% indicating participation of a large number of players in this market. This fragmented industry structure is primarily due to the availability of number of pack types and raw materials used for flexible packaging. |

Beverage Packaging: Market Revenue, By Material, 2012 & 2018 (US$ mln) |

|

Source: MarketsandMarkets Analysis |

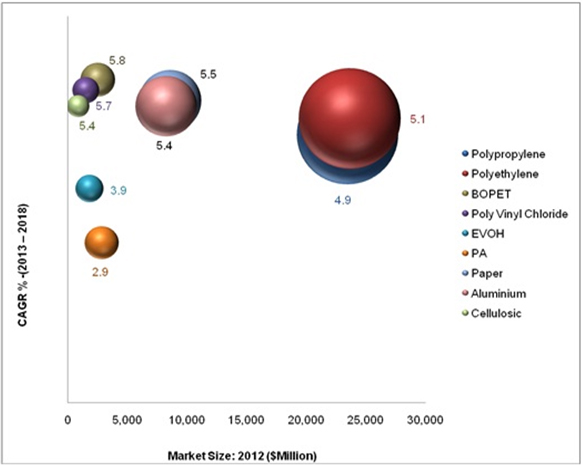

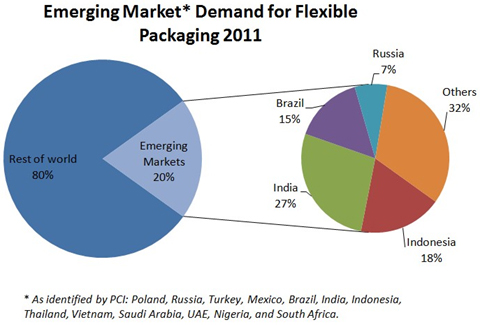

The figure above shows the growth trend from 2013 to 2018. The global flexible packaging market is projected to grow at a CAGR of 5.1% from 2013 to 2018. Polyethylene dominated this global market by material accounting nearly 32% of the total market share and is projected to grow at a CAGR of 5.1% during the forecast period. Polypropylene accounted for the second largest share in the segment growing at a CAGR of 4.9% during the period under review. Polypropylene comprises of Biaxially oriented polypropylene (BOPP) and Cast polypropylene (CPP). Of these two, the BOPP segment holds a significant share of around 80%, growing at a CAGR of 5.2% from 2013 to 2018. Paper and Aluminum are growing at a CAGR of 5.5% and 5.4% respectively. Cellulosic is one of the materials which show potential growth in the future. It is projected to grow at a CAGR of 8.2% through to 2018. The North American market is expected to show a modest growth trend, owing mainly to the saturated end-use markets in the region. The European market, which has also witnessed signs of maturity, is given a small boost by the East European nations. Environmental awareness among consumers has meant that there is a swing in market shares among the packaging materials. Changing consumer preferences and high disposable incomes in APAC economies drives the end-use market. The APAC region is leading in the flexible packaging market shares. Developing economies such as China and India are driving the growth in this region. Consumer preferences in convenience foods, westernized eating habits in terms of packaged food demands, and rising disposable incomes are some of the important factors influencing the trend. In the same way, the growing food and beverage processing industry in Brazil and other Latin American countries drives the growth in ROW. The Olympic Games 2016 scheduled in Brazil will also act as a significant boost to the tourism industry, and in turn the consumption of packaged food in the region. Most of the countries in the Asia-Pacific are emerging economies that exhibit a strong economic growth in the future. With the growth in per capita income, consumers have adopted trends and preferences from the developed western markets. The growing population and the consequential demand for packaged food, beverage, personal care products, and pharmaceuticals are driving the markets in these developing regions. China and India are heading these growth trends. The thriving food & beverage, personal care products and pharmaceutical processing industries and the increasing consumer awareness regarding benefits of these products and their packaging types are the key fundamentals driving the markets in these regions. Total demand for flexible packaging in the world’s emerging markets is valued at US$14 bln in 2011, representing around 20% of the global total of around of around US$70.6 bln, finds PCI's latest market report. Increasing use of flexible packaging and subsequent investment in converting capacity in many markets will expand the size of the emerging markets by at least 50% by 2016. Over the last five years, average flexible packaging growth has been 11% in the emerging markets; twice that of the world average. India accounts for around 27% of total emerging market flexible-packaging production, although Indonesia, Brazil, and Russia are also significant production centers. The report has identified 13 emerging flexible packaging markets comprising of Poland, Russia, Turkey, Mexico, Brazil, India, Indonesia, Thailand, Vietnam, Saudi Arabia, UAE, Nigeria and South Africa. Collectively these markets, valued at US$14 bln, have grown by almost 70% since 2006 and currently account for 20% of total world demand. One of the key findings is that although a number of these emerging markets have been affected by the global economic downturn, they have weathered the crisis well, with demand growth averaging almost 11% pa since 2006, led by countries including India, Indonesia, Brazil and Russia. In general, all emerging markets have illustrated strong growth over the past five years, with only 3 of the 13 posting overall growth of less than 30% between 2006 and 2011. The major driving forces in flexible packaging demand within these emerging markets include strong GDP growth, high population growth, liberalisation in a number of markets, continued urbanisation and the development of mass retailing. In addition, changing consumer lifestyles and increasing disposable incomes have encouraged the development of new convenient packaged food and non-food products. |

|

|

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}