|

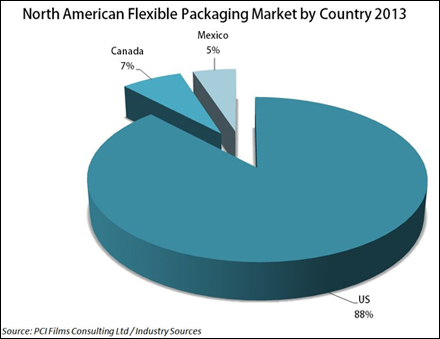

Demand in North America’s converted flexible packaging market has been underpinned by recovering economies and flexible packaging formats being used as alternatives to traditional rigid packaging. The North American converted flexible packaging market accounts for approaching 30% of global consumption with an annual spend of US$20.7 bln in 2013, reveals a new report from PCI Films Consulting. Almost 90% of sales in the region are concentrated in the US, with Canada and Mexico accounting for 7% and 5% respectively. After slowing in 2012 due to the economic downturn, demand for converted flexible packaging recovered to grow by around 4% by value in the US and Canada in 2013. However, the Mexican flexible packaging market slowed markedly during the year to around 1.5% due to uncertainties following the change of government and slowing GDP growth. Weakening margins and other competitive pressures caused significant rationalization and restructuring in the region with many plant closures and divestments, especially amongst the leading players. The report notes that industry consolidation continues to be an important factor in driving change in this very fragmented industry with private equity firms continuing to play a key role. Important private equity deals in 2013 have included Constantia Flexibles’ acquisition of Globalpack, both portfolio investments of One Equity Partners, and Constantia’s subsequent purchase of the US-based Spear Labelling Group. Also, private equity firm Sun Capital brought together its Exopack Holdings business in North America and four of its packaging portfolio businesses in Europe to form Coveris Exopack Holdings. For the future, converted flexible packaging growth in North America is forecast to average around 4% pa to reach over US$25 bln by 2018 with growth in Mexico expected to bounce back to grow at US and Canadian levels over the period. Per capita consumption of flexible packaging in Mexico is less than one-fifth of the US figure, illustrating its potential for future growth. The North American Free Trade Agreement (NAFTA) also continues help drive demand in Mexico, with many US packaged food companies manufacturing in Mexico for the US market to take advantage of lower labour rates. PCI consultant Paul Gaster says: “While the economic slowdown adversely impacted the flexible packaging industry’s profitability, volume growth has continued to be sustained by servicing primarily defensive markets such as food, pharmaceuticals and pet food. Also, as packaging technologies have evolved, flexible packaging is becoming a viable alternative to rigid formats in a growing number of applications, with the stand-up pouch enjoying strong volume growth.”

|

|

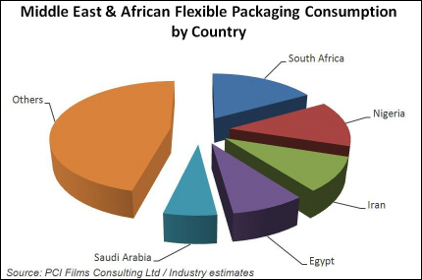

| PCI Films Consulting forecasts that flexible packaging demand in the Middle East and Africa will grow by around 5% p.a. over the next five years as confidence in the region’s growing economy encourages inward investment and greater emphasis on mass food processing. In 2013, the market for flexible packaging in the Middle East and Africa is valued by PCI at approaching US$4 bln. With consumption per capita currently only around US$3 compared to Europe’s US$30, there is clearly huge potential for future growth in the region’s flexible packaging market. As countries in the region grow their economies, and look to improve transport and distribution infrastructure and encourage inward investment, more and more multinational brand owners are recognizing the potential for local packaged food production to supply the region’s expanding needs. Five countries; South Africa, Nigeria, Iran, Egypt and Saudi Arabia currently account for over half of total consumption of converted flexible packaging in the region. The most dynamic market is Nigeria, where flexible packaging demand has grown by around 12% p.a. over the past five years. Other smaller markets such as Tanzania, UAE have also seen above average growth. In contrast to the generally positive picture, flexible packaging sales in Iran and Syria have experienced steep declines due to political, social and economic instability. |

Factors driving flexible packaging growth in the region include:

|

The region continues to be a net importer of flexible packaging especially into Africa, much being sourced from Europe and increasingly from India and China with the leading European and American owned multinational converters having virtually no local production capability in the region. There is also substantial intra-regional trade, with converters in Saudi Arabia and UAE making use of the films produced as part of downstream petrochemical diversification within those countries. Also Indian entrepreneurs have successfully established thriving converting operations in Nigeria and the UAE. The region’s flexible packaging industry remains very fragmented. Of over 350 converters identified by PCI, the top 20 players account for only around 40% of production. |

|

Previous Article

Next Article

{{comment.DateTimeStampDisplay}}

{{comment.Comments}}